How Do I Track My South Carolina Tax Refund?

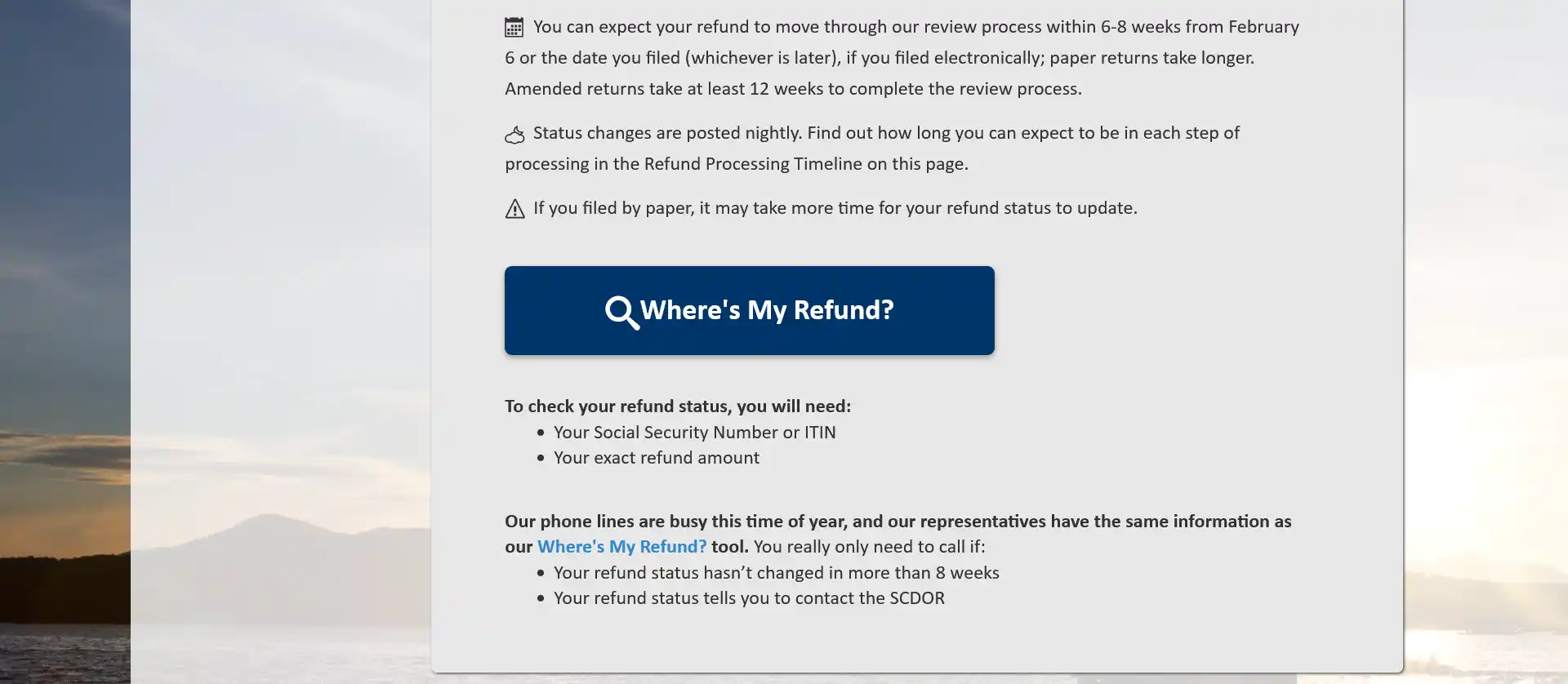

You can check the status of your South Carolina tax refund using the “Where’s My Refund?” tool. Scroll down until you see “Where’s My Refund?” button and click it to continue.

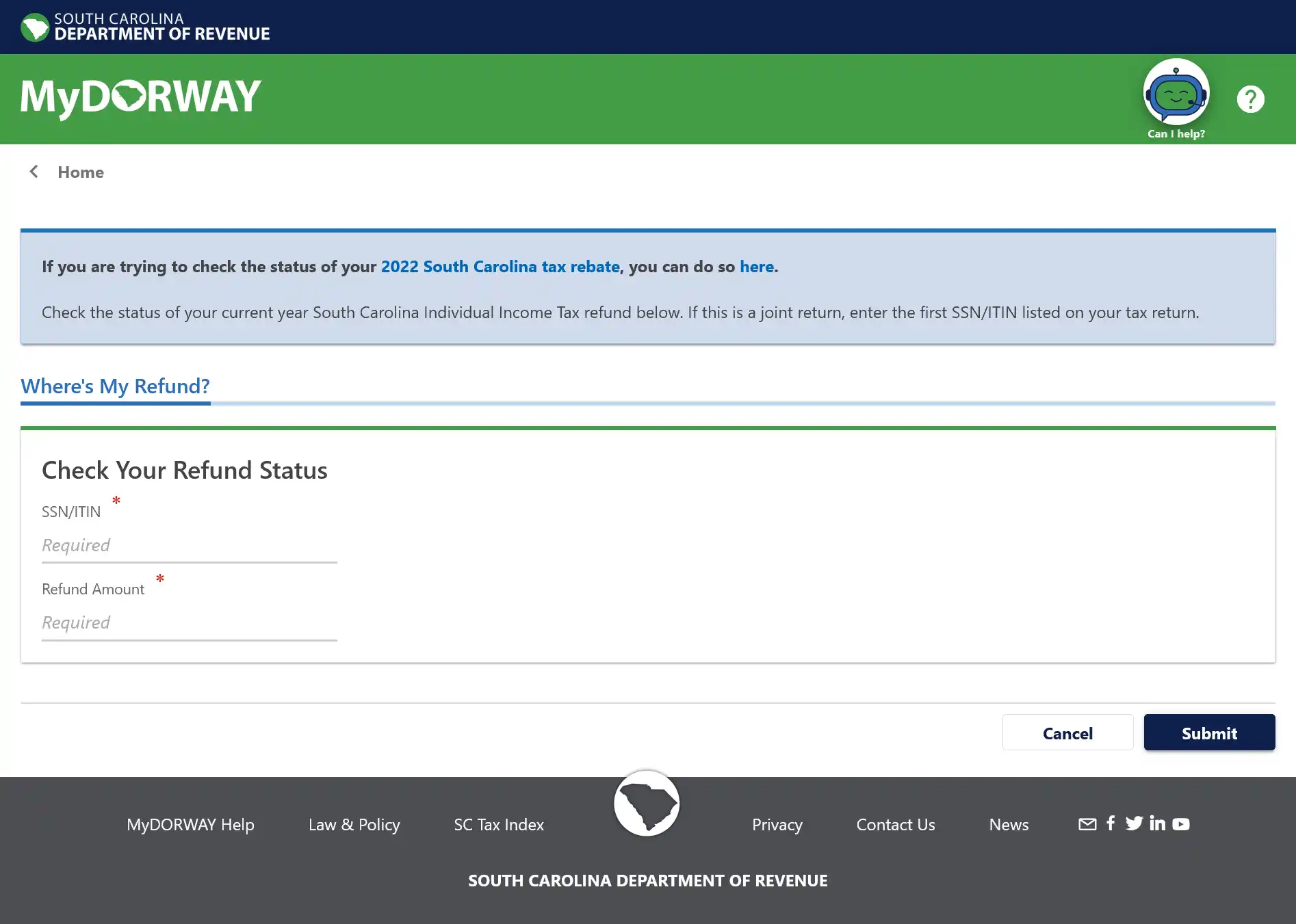

You will now be on the “Check Your Refund Status” page.

On this page, you will need to enter your:

- Social Security Number or ITIN

- Exact refund amount

Then, click “Submit” to view your refund status.

Refund FAQs:

How long will it take to get my South Carolina tax refund?

If you e-filed, you can expect to receive your refund within 6-8 weeks. Paper returns take longer to be processed.

What slows down your tax refund?

Your refund may be delayed if:

- It’s your first time filing a tax return in South Carolina.

- Your return requires extra review.

- You need to provide additional verification.

- You choose to receive your refund by paper check.

Why is my refund amount different from when I filed?

Your refund amount may be different if the South Carolina Department of Revenue (SCDOR) made changes to your tax return. They are also authorized to seize all or part of your refund to debts owed to government agencies or institutions of higher learning. The remaining portion of your refund will be distributed to you. You will receive a letter detailing any changes that have been made and who to contact if you have any questions.