How Do I Report a Rollover?

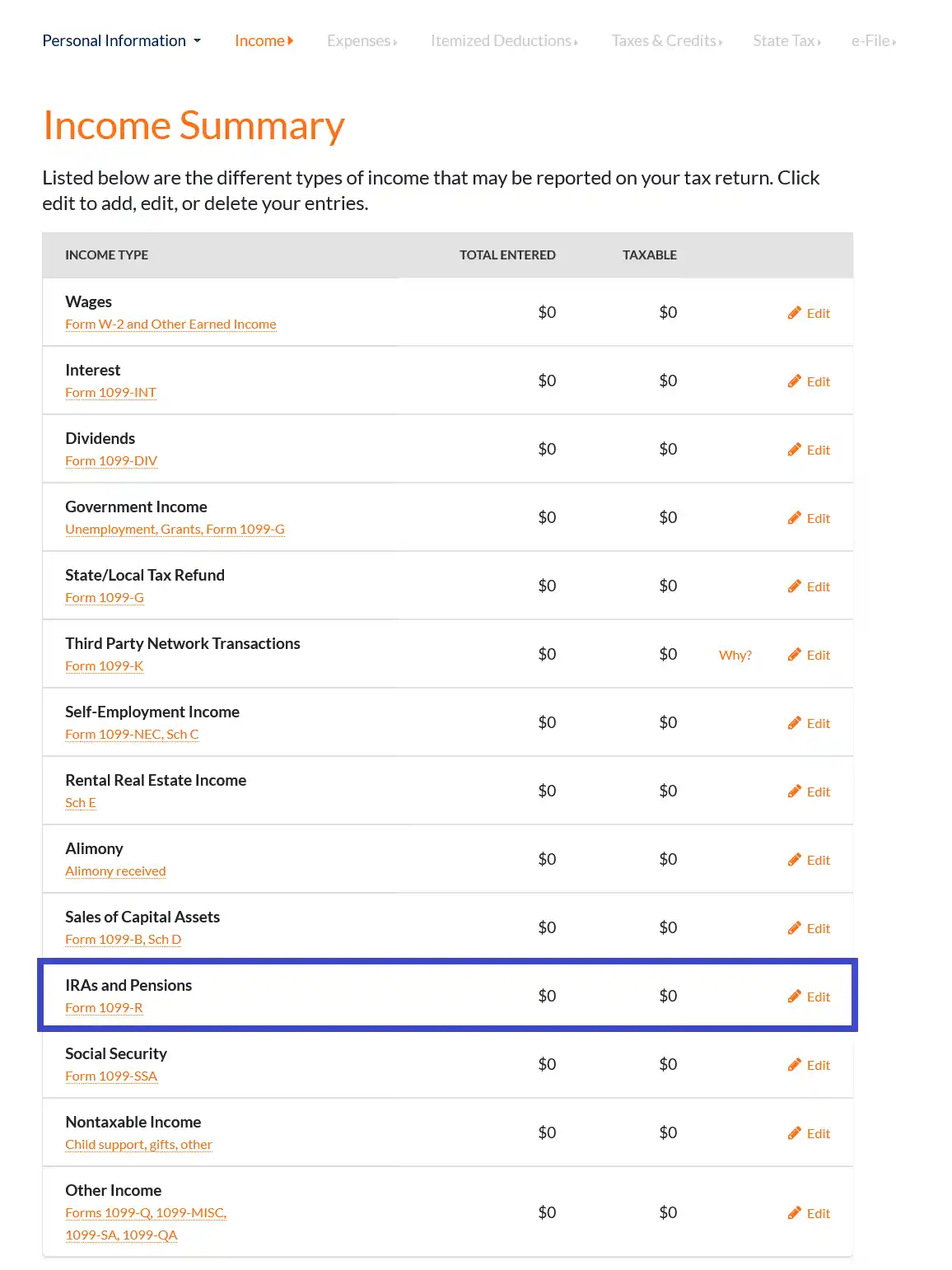

You should get a Form 1099-R from your plan administrator reporting your rollover. 1099-R forms are entered in the "IRAs and Pensions" section of the "Income" section of the program.

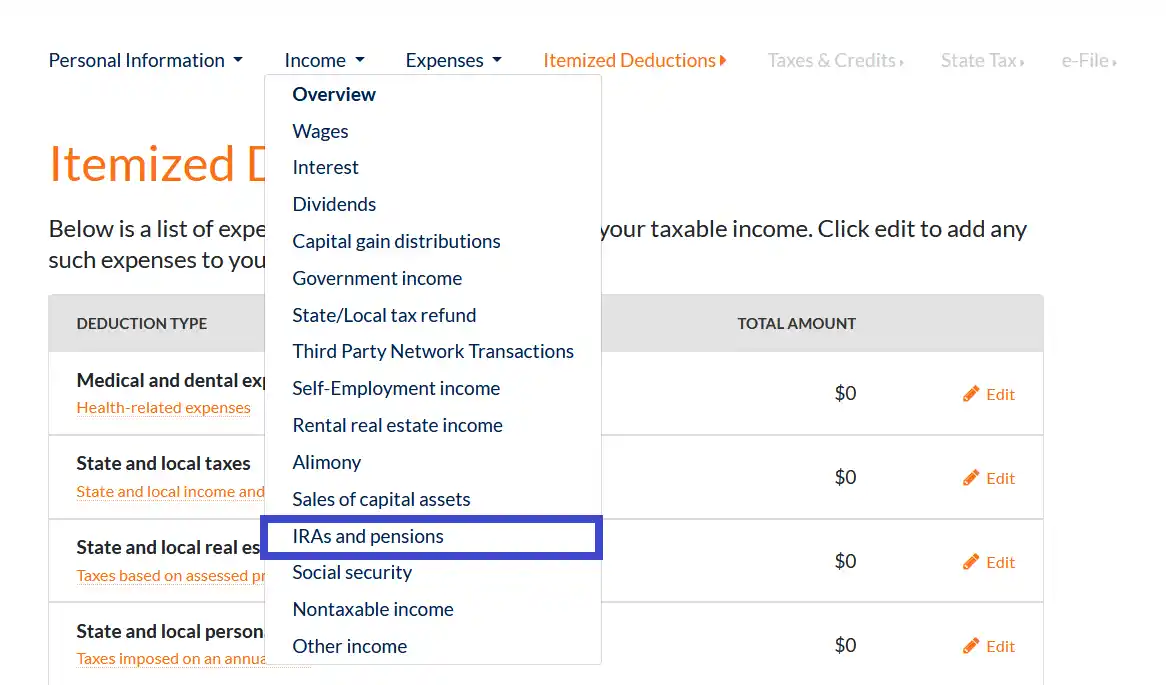

If you have already passed this section of the program, you can click the "Income" link on the navigation bar towards the top of the page and select "IRAs and Pensions" from the drop-down menu.

If you are on the "Income Summary" screen, click on the "edit" link on the "IRA's and Pensions" line to add, edit, or delete a 1099-R entry.

If you transferred the full distribution amount into another IRA or qualifying retirement plan, you can select that option when prompted by the program

Note: Our program currently does not support partial rollovers.

FAQs

What is a rollover?

A rollover is when you move your retirement savings from one plan to another such as a 401k to an IRA. This is usually done within 60 days of receiving the distribution. When you rollover your old retirement account, the funds will continue to grow tax-deferred, and you’ll avoid early withdrawal penalties.

How long do I have to rollover my 401k after leaving a job?

You must rollover your 401k distribution to another plan or IRA within 60 days. However, the IRS may waive the requirement if you missed the deadline due to a situation that’s out of your control. For more details, click here.

Do you pay taxes on a rollover?

Generally, you won’t pay any taxes if you do a direct rollover from your employer-sponsored plan into a traditional IRA. However, rollovers into a Roth IRA are taxable.

With an indirect rollover, your old plan will send you a check minus an amount withheld for taxes that may be 20% or more. To deposit your full account balance, you will need to replace the amount that was withheld. If you don’t complete the rollover within 60 days, your distribution may be taxable. You may also be subject to a 10% early withdrawal penalty if you are under age 59½.

What tax forms will I receive for my rollover IRA?

If you rollover your 401k to an IRA, you will receive a 1099-R from your plan administrator. How you complete the rollover will dictate whether taxes are withheld and how it’s reported on your 1099-R.

For a direct rollover:

- Box 1 (Gross distribution) – Shows the total amount distributed.

- Box 2a (Taxable amount) – Should be zero.

- Box 7 (Distribution code) – Should be “G”.

For a 60-day rollover:

- The amount in Box 2a may be the same as Box 1 or less.

- If box 2b (Taxable amount not determined) is checked, you’ll need to calculate the taxable amount yourself and report it on your tax return.

- Your distribution code in Box 7 will either be 1 (Early distribution) or 7 (Normal distribution).

You will also receive an informational Form 5498 summarizing your IRA contributions, rollover contributions, and fair market value.