How Do I Track My Pennsylvania State Refund?

You may check the status of your Pennsylvania tax refund online by visiting myPATH - Home

Click on “Where’s My Refund?” under the “Refunds” section.

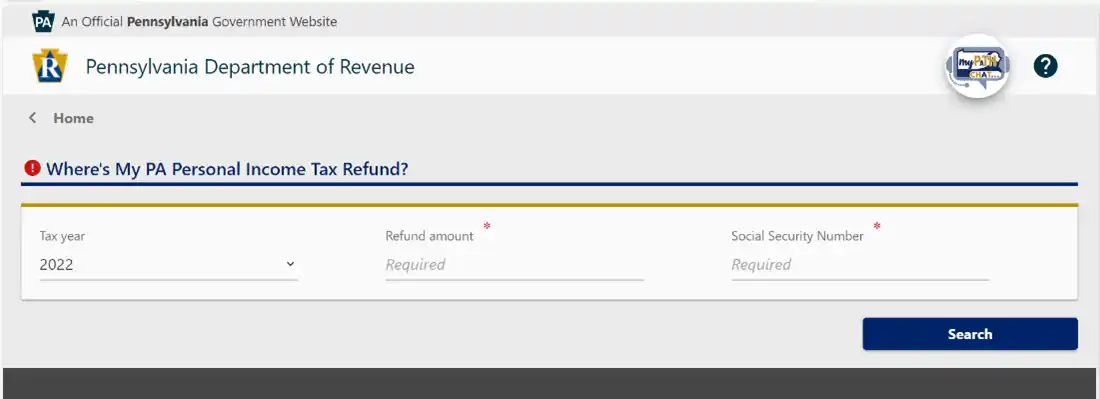

1. Enter tax year.

2. Enter refund amount.

3. Enter your social security number.

Click on “Search”.

Refund FAQs:

1. How do I submit additional information to process my refund?

The Pennsylvania Department of Revenue encourages filers to submit any requested information electronically.

Email: RA-BITPITHOLDCORFAXE@pa.gov (.pdf format only).

Fax: 717-783-5823

2. I mailed in some requested information to the Pennsylvania Department of Revenue. When will I receive my refund?

Mailed documents take longer to process than information sent electronically. Processing can take about six weeks to enter into the system. Then, it takes an additional three to four weeks for review. After review, it takes an additional three to four weeks for you to receive a refund check.

3. Why doesn't my refund amount match your records?

If you e-filed it may take 1 to 3 business days for it to show up in Pennsylvania’s automated system. If you mailed in your tax return (the PA-40 form), it can take about 8 to 10 weeks. Until your return is available in their system, you are going to keep getting a message saying that the amount you entered doesn’t match their records.

4. What if myPATH has no record of my personal income tax return, where is my refund?

If you e-filed more than a week ago and your refund is not showing up on myPATH, call the Customer Experience Center at 717-787-8201. If you sent in a paper return, wait at least ten weeks from the date you mailed it before reaching out.