How Do I Track My North Carolina State Refund?

You may check the status of your North Carolina online by visiting: https://www.ncdor.gov/refund

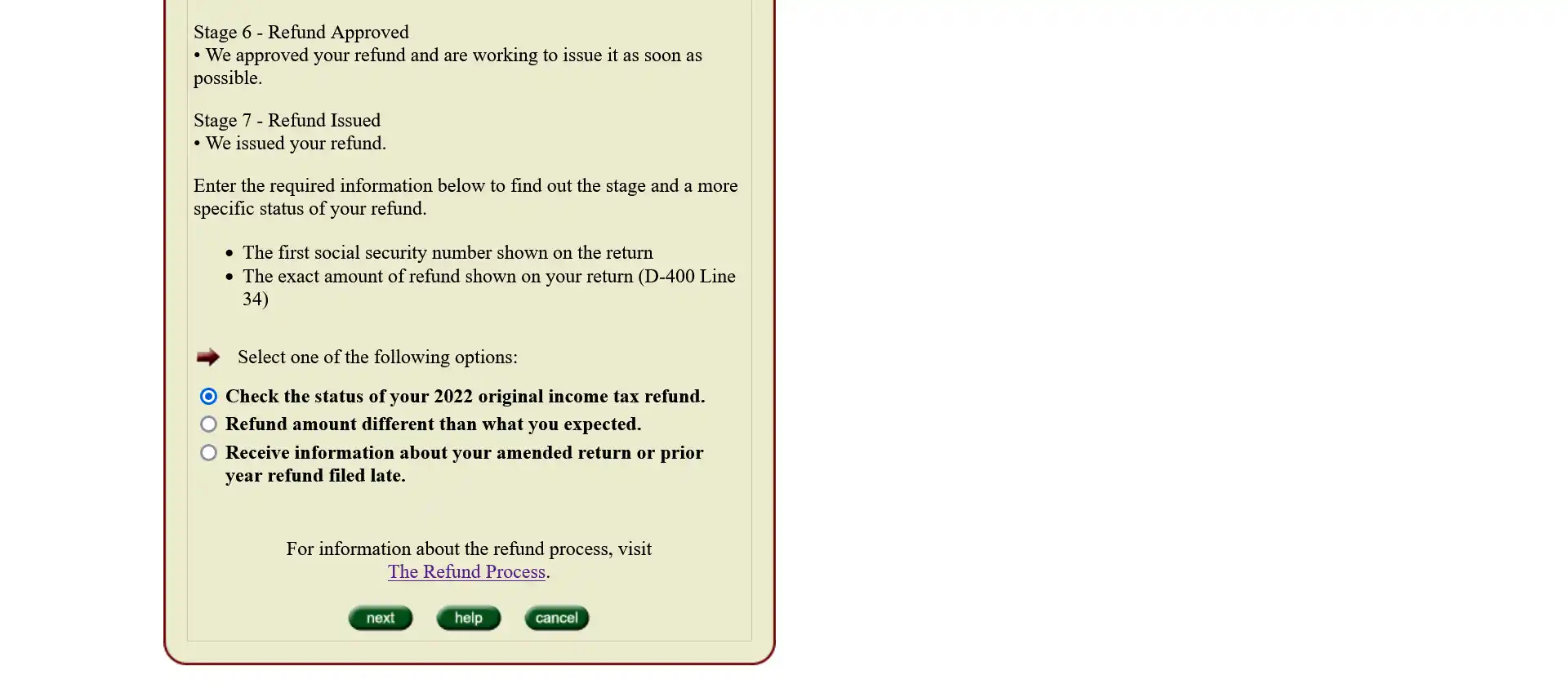

1. Click the “Check your refund status” button.

2. Select the following option: Check the status of your 2022 original income tax refund.

3. Click “Next”

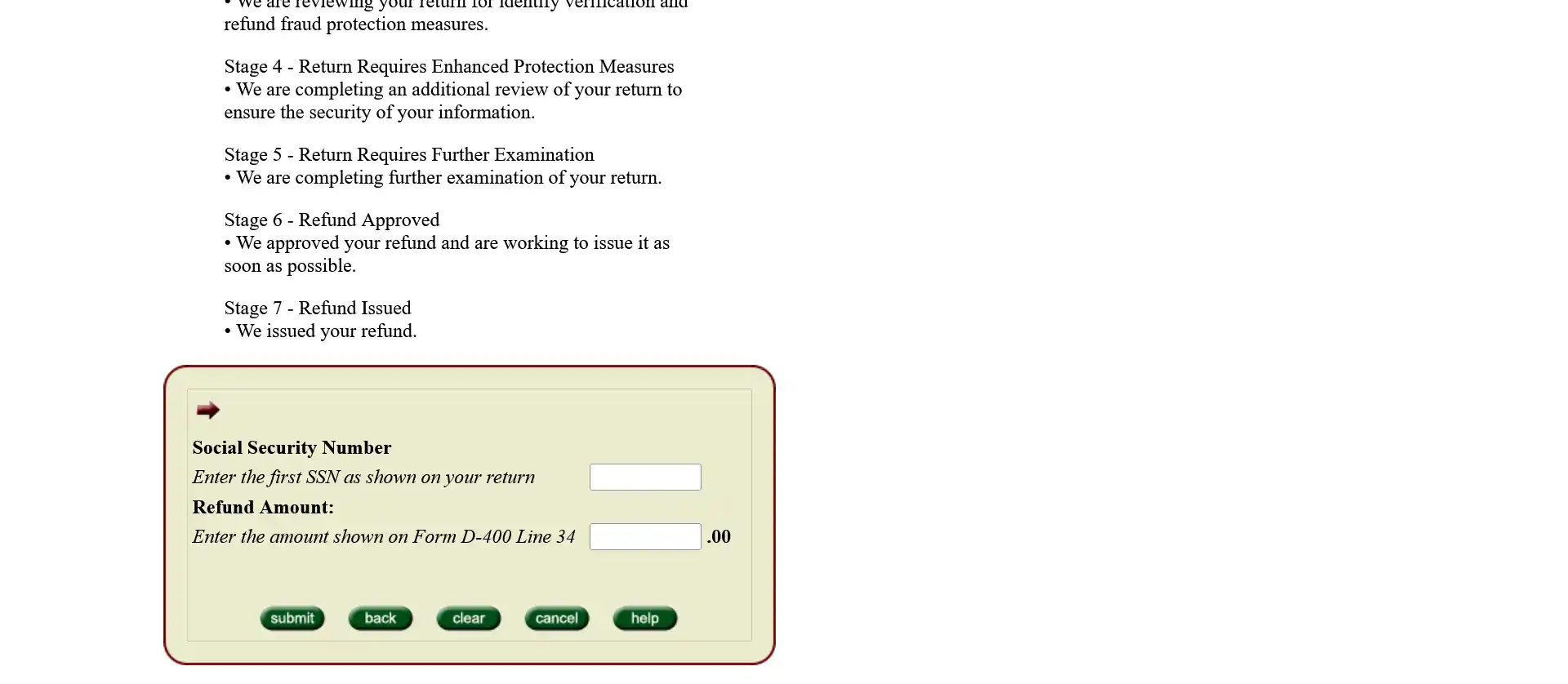

4. Enter your social security number.

5. Enter your refund amount.

6. Once you’ve entered the required information, click “Submit”.

Refund FAQs:

1. When should I receive my North Carolina state tax refund?

The N.C. Department of Revenue (NCDOR) issues most refunds within approximately 3-6 weeks of e-filing. Up to 12 weeks if you paper filed.

2. How often are North Carolina state tax refund checks mailed?

Tax refund checks are mailed weekly.

3. What do I do if my refund check is lost, stolen, or destroyed?

If your refund check is lost, stolen, or destroyed, you must submit an Affidavit and Indemnity Bond form. You will need to include your:

- Current Address

- Social Security Number

- Tax Year

- Check Number or Date.

NOTE: You must have two copies of your affidavit notarized by a notary public otherwise it will be considered invalid and will not be processed.

Mail the copies of your affidavit to:Customer Service

Post Office Box 1168

Raleigh, NC 27602-1168

4. How long do taxpayers have to cash a refund check before it expires?

North Carolina state refund checks are good for 6 months after the date they are issued. After 6 months, your refund check will not be valid anymore and you will not be able to deposit it in the bank. To get a new refund check, mail a letter along with your expired refund to the NC Department of Revenue.

| Date on the check | How to request a new refund check | Processing time |

|---|---|---|

| 6 months or more | You must mail a written request along with your expired refund check to NC Department of Revenue. Your check will be re-validated and re-mailed to you. | N/A |

Mail your request to:

NC Department of Revenue

Attn: Customer Service,

P.O. Box 1168

Raleigh, NC 27602

5. Will I get a refund if I owe the IRS or a state agency?

If the Department of Revenue finds that you owe money to a different government agency, there may be a debt set-off and the debt amount will be withheld from your refund. The Department of Revenue will notify you and will refund any remaining balance to you. The agency receiving the amount set-off will also notify you. If you think the amount they're taking is wrong, you should get in touch with the agency that you owe the money to.

6. I changed my address after I sent my tax return. My refund check might have been sent back because they couldn't deliver it. What should I do to make sure I get my check at my new address?

If your refund check Is undeliverable, it will be returned to the NC Department of Revenue. You must update your address and complete the “Change of Address Form for Individuals” online, call the Department of Revenue, or mail in a request in writing.

| How to request a new refund check | Processing time |

|---|---|

|

1. Fill out an online form to update your address and complete the “Change of Address Form for Individuals”. Visit https://www.ncdor.gov/change-address-form-individuals.

2. You can also call the NC Department of Revenue to change your address at 1-877-252-3052. 3. Or you can submit a written request to change your address. |

N/A |

To submit change your address in writing, mail to:

North Carolina Department of Revenue

Attn: Customer Service

P.O. Box 1168

Raleigh, NC 27602-1168

7. When will I receive my refund for an amended return?

You should get your amended refund within six months of filing. If you have been waiting for more than five months, call the NCDOR at 1-877-252-3052 for assistance. When you call, choose the option for "Individual Income Tax" and then listen for the "Refund" option to talk to someone. Do not call 1-877-252-4052 as mentioned in the main message. Please note, you will also get some interest added to your updated refund at the current rate.