Can I Track My NY State Tax Refund?

You may check the status of your New York tax refund by visiting https://www.tax.ny.gov/pit/file/refund.htm

1. Click “CHECK REFUND STATUS”.

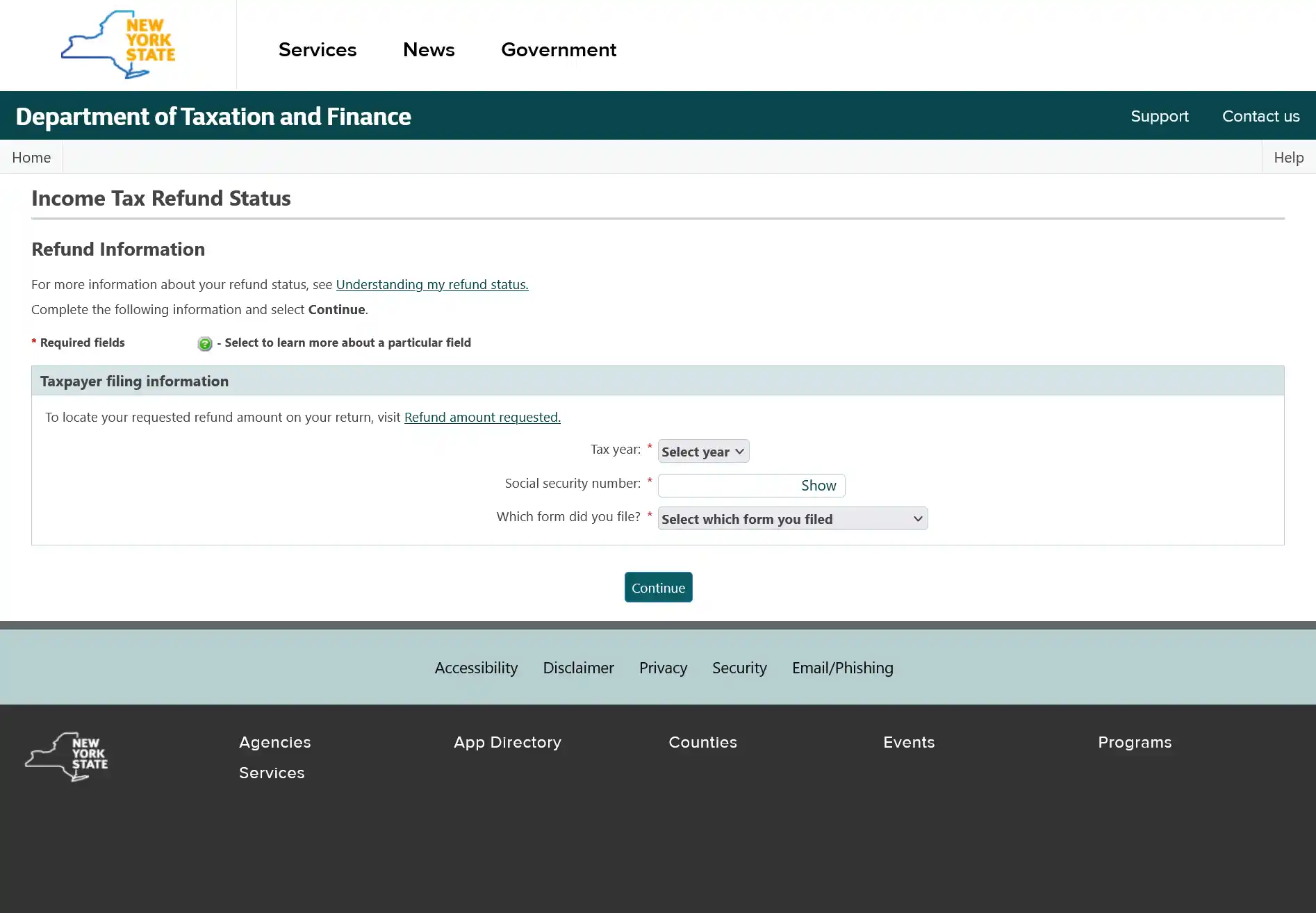

2. Select the tax year from the dropdown menu.

3. Enter your social security number.

4. Enter which form you filed.

5. Once you’ve entered the required information, click “Continue”.

Refund FAQs:

1. How do I find my NYS tax refund amount?

Find the refund amount on your tax return by visiting: https://www.tax.ny.gov/pit/file/refund.htm#locate

Scroll down the page to “Locate your requested refund amount” section and use the provided chart.

2. Can I check the refund status of an amended return?

No, you cannot check the refund status of an amended return using the online tool. You must call 518-457-5149.

3. Can I call to check the status of my New York state tax refund?

The NY Department of Taxation and Finance gets millions of calls each year for refund status updates and there may be a long hold on the phone. You can call the automated phone line (518-457-5149). However, you are encouraged to use the online refund tool because it’s a quick and easy way to check.

4. Can I get notified when my tax refund is processed?

Yes, you can be notified when your refund is processed. You must create an Online Services account to sign up for a notification. Go to: https://www.tax.ny.gov/online/createaccount.htm.

5. Why did NYS adjust my refund?

If the New York State Department of Taxation and Finance made adjustments to your tax return, your refund amount may have changed. You will receive a Form DTF-160 or Form DTF-161 in the mail explaining why your refund amount is different than you expected.

6. What if the online refund status says I was sent a letter requesting additional information?

If you get this message, it means the Department of Taxation and Finance needs some more details from you to process your refund. You will receive you a letter called "Request for Information" (Form DTF-948 or DTF-948-O) that explains what information is needed from you.

Please note, you don’t need to wait to receive the letter in the mail. You can view the notice online in your Online Services Account and use the ‘Respond to Department Notice’ application to respond.