Where’s My New Jersey State Tax Refund?

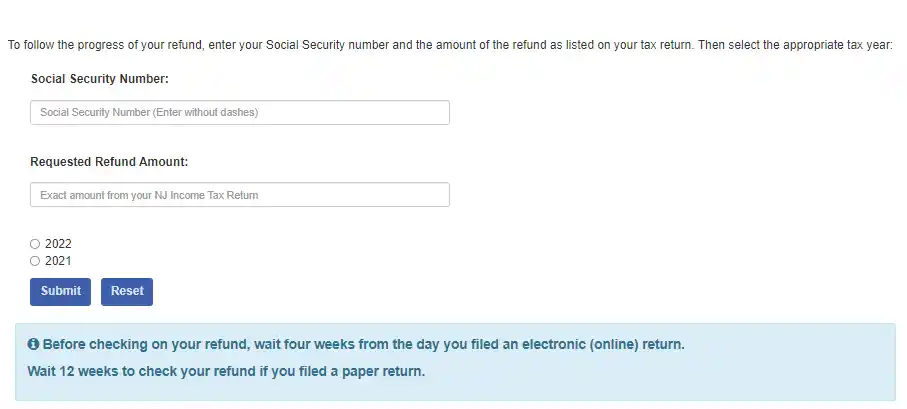

You may check the status of your New Jersey tax refund online by visiting: https://www16.state.nj.us/TYTR_TGI_INQ/jsp/prompt.jsp

1. Enter your social security number.

2. Enter your refund amount.

3. Enter the selected tax year.

4. Click “Submit”.

Refund FAQs:

1. Can I track my NJ state tax refund?

Yes, you can check your refund status online or by phone. For phone inquiries, please contact the NJ Division of Taxation at:

- 1-800-323-4400 or

- (609) 826-4400

The phone lines are open 7 days a week. You will need to provide your social security number and refund amount.

2. When can I start checking my refund status?

You can check the status of your New Jersey refund 4 weeks after you’ve e-filed. If you paper filed, the processing time is 12 weeks. Please note, manual processing of returns takes longer.

3. How do I get an expired refund check reissued?

If your refund check has expired, you must send the New Jersey Division of Taxation a letter requesting a replacement check.

Mail your request to:NJ Division of Taxation Taxpayer Accounting Branch PO Box 266 Trenton NJ 08695-0266

- If you have the expired check, include it with your written request.

- Do not write the “VOID” on the check.

- Keep a copy for your records.

- If you cannot return the refund check by mail, visit one of the Regional Information Center to return it.

4. How do I replace a lost, stolen, or destroyed refund check?

If your refund check is lost, stolen, or destroyed, you can request a replacement by calling the NJ Division of Taxation Customer Service Center at 609-292-6400.

You can also request a check tracer for your NJ refund by calling the Division’s Automated Refund Inquiry System at 1-800-323-4400 or 609-826-4400. It takes 60 days for a replacement check to be issued.