How Do I Track My Mississippi State Tax Refund?

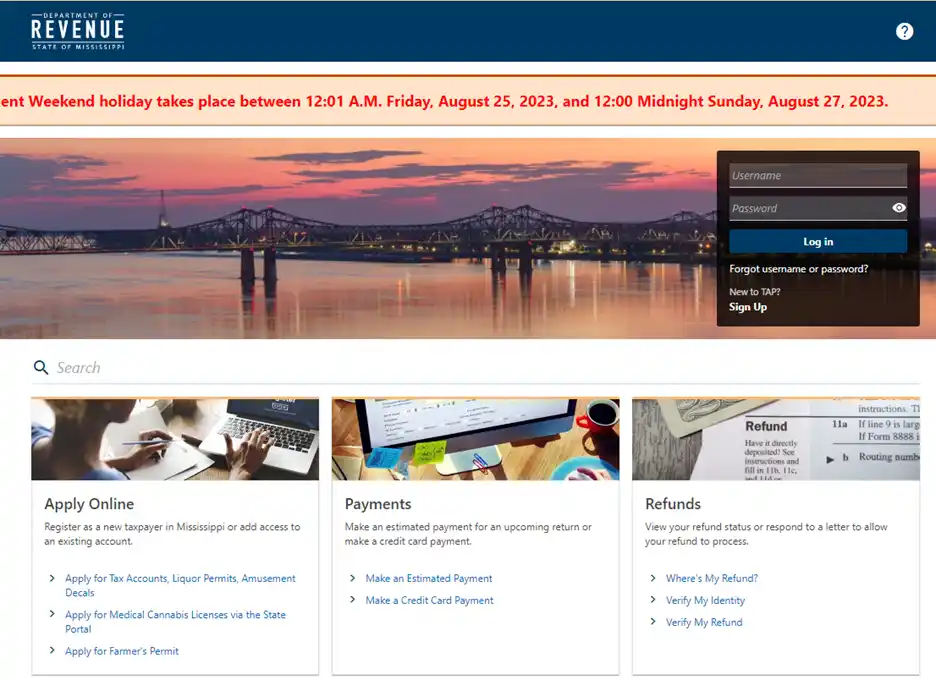

You may check the status of your Mississippi tax refund by visiting the TAP online refund tool: https://tap.dor.ms.gov/_/. You do not need to register.

1. Scroll down to “Refunds” and click “Where’s My Refund?”.

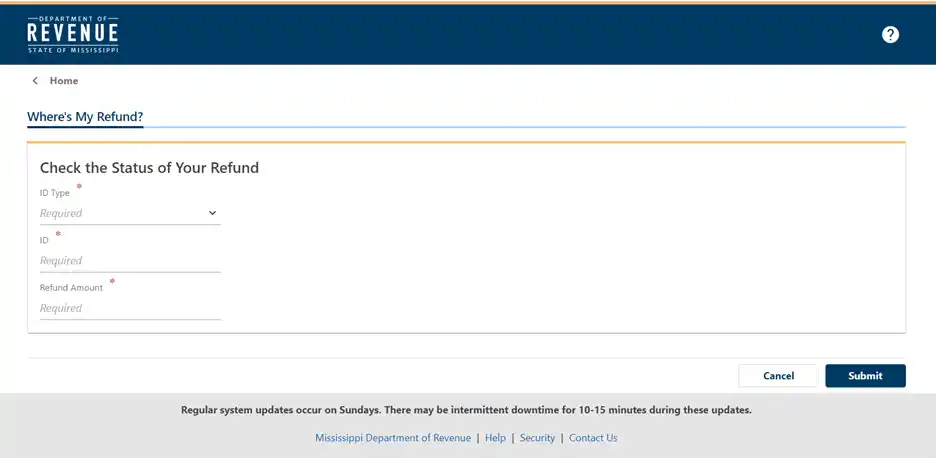

2. Select the ID Type from the dropdown menu. You can choose Fed Employer ID, ITIN, or your social security number.

3. Enter your selected ID.

4. Enter your refund amount.

5. Once you’ve entered the required information, click “Submit”.

Refund FAQs:

1. How long does MS state tax refund take?

If you e-filed, you should wait ten business days before calling to check the status of your refund. It usually takes at least 10 weeks before you are mailed a refund check. Tax returns filed earlier (than later) are usually processed faster.

(601) 923-7801 – 24 Hour Refund Line

(601) 923-7700 – For General Questions (8am-5pm)

For more contact information, go to: https://www.dor.ms.gov/contact/contact-information

2. What do I do if my refund check is lost?

If your refund check is lost, you should request another refund check in writing from the Department of Revenue.

| How to request a new refund check | Processing time |

|---|---|

|

Send a request in writing including:

|

8-10 weeks |

Individual Income Tax Division P.O. Box 1033 Jackson, MS 39215-1033

3. How long do taxpayers have to cash a refund check before it expires?

Refund checks are good for 12 months after the date they are issued. After one year, your refund check will be considered as “unclaimed property”, and you’ll need to file a claim with the Division of Unclaimed Property at the State Treasury.

| Date on the check | How to request a new refund check | Processing time |

|---|---|---|

| 1 year or more |

You must file a claim with the Division of Unclaimed Property at the State Treasury. You must have the completed form notarized and include the property identification number. |

N/A |

You can find the Mississippi Unclaimed Property form here: https://treasury.ms.gov/wp-content/uploads/2020/06/Claim-Form-and-Requirements-4.23.19.pdf

Mail your request to:Office of the State Treasurer Division of Unclaimed Property P.O. Box 138 Jackson, MS 39205 (601) 359-3534

4. Why was my refund taken to offset a debt?

If the Department of Revenue finds that you owe money to a different government agency, they might take that amount from your refund. In this case, they will send you an “Intent to Offset” notice. This could be for things like unpaid child support, a student loan you owe to a university, or money you owe due to unemployment benefits. If you think the amount they're taking is wrong, you should get in touch with the agency that you owe the money to.

5. How do I get my refund check if my bank account is closed?

If you asked for your refund to be direct deposited but your account is now closed, the money will go back to the Mississippi Department of Revenue. No action is needed from your side. They will send you a check by mail to the address they have. This might take a few extra weeks.