Why Can’t I E-File My Federal Return?

Earned minimal or no income last year? If your gross income falls below the IRS filing threshold, you do not have to file a tax return. In fact, your return may be rejected when you e-file if it does not contain any taxable income, credits, or payments. It would be as though you are submitting a blank tax return. If you are not obligated to file, but wish to do so anyway, we can help.

How do I file a return with no taxable income?

If you still want to file a tax return, you will need to add $1 to your taxable income. This will not generate any amount of tax due, it will simply allow you to e-file. Let’s get started!

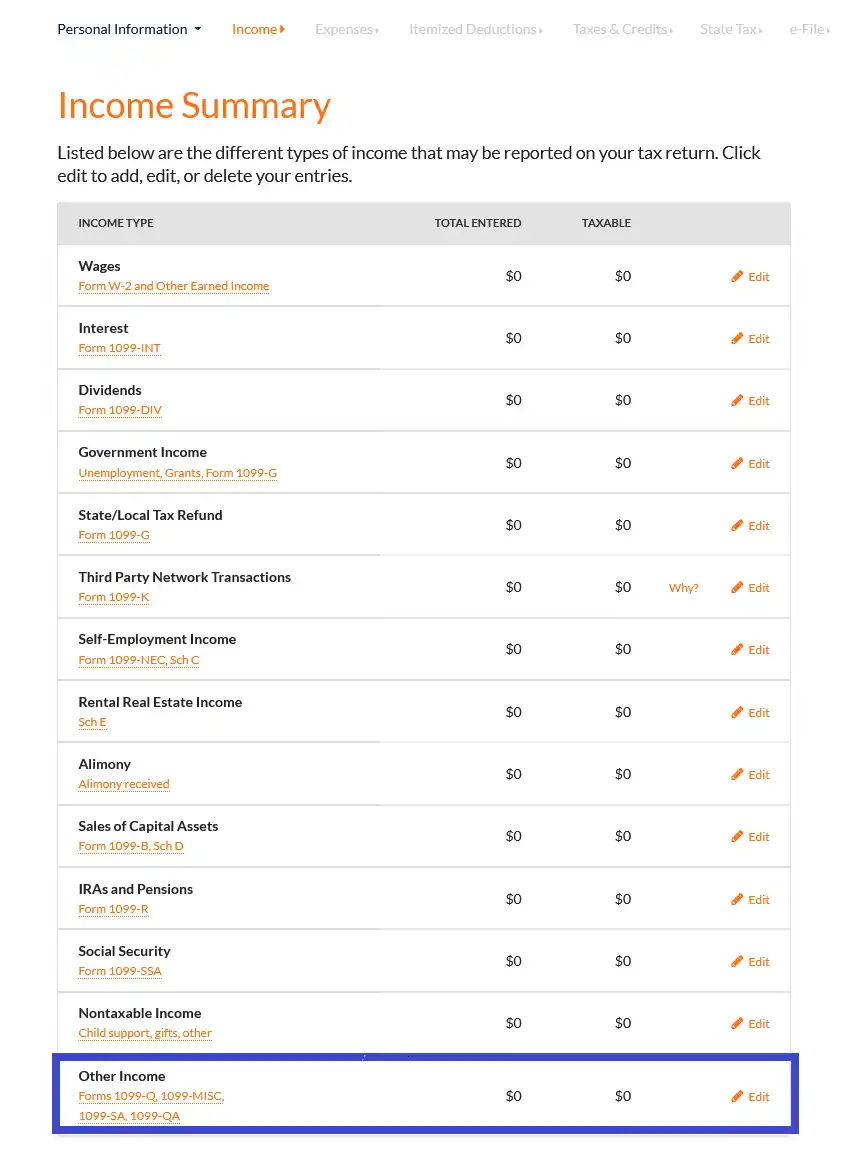

Log into your account and go to the "Income” section of the program. Select "Edit" next to Other Income.

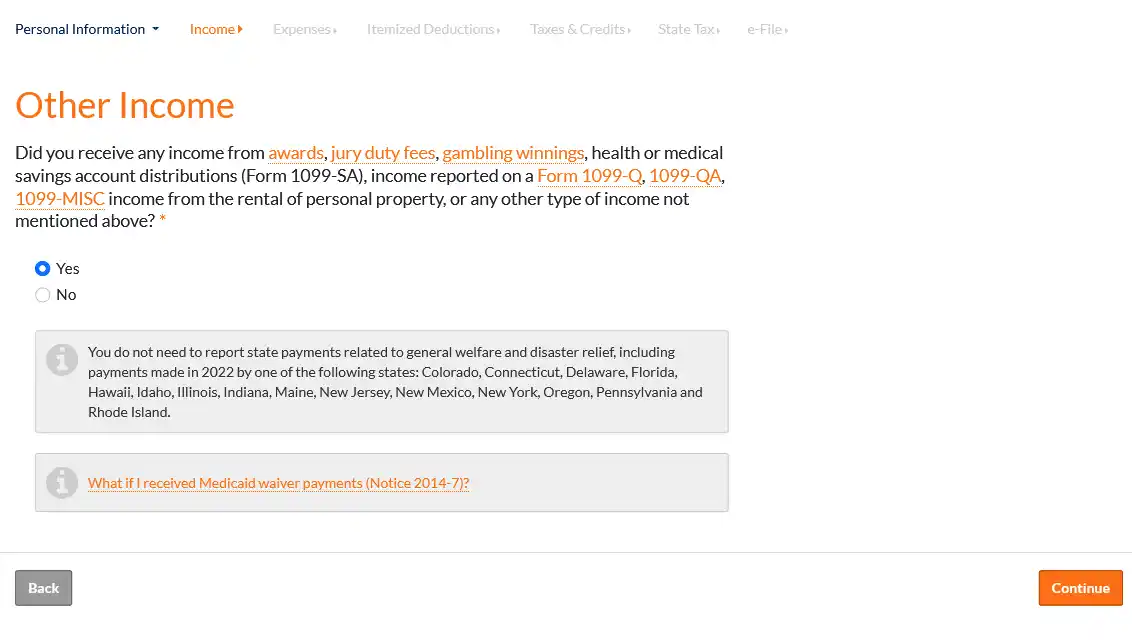

This will bring you to the “Other Income” page.

Select "Yes",then click the "Continue" button.

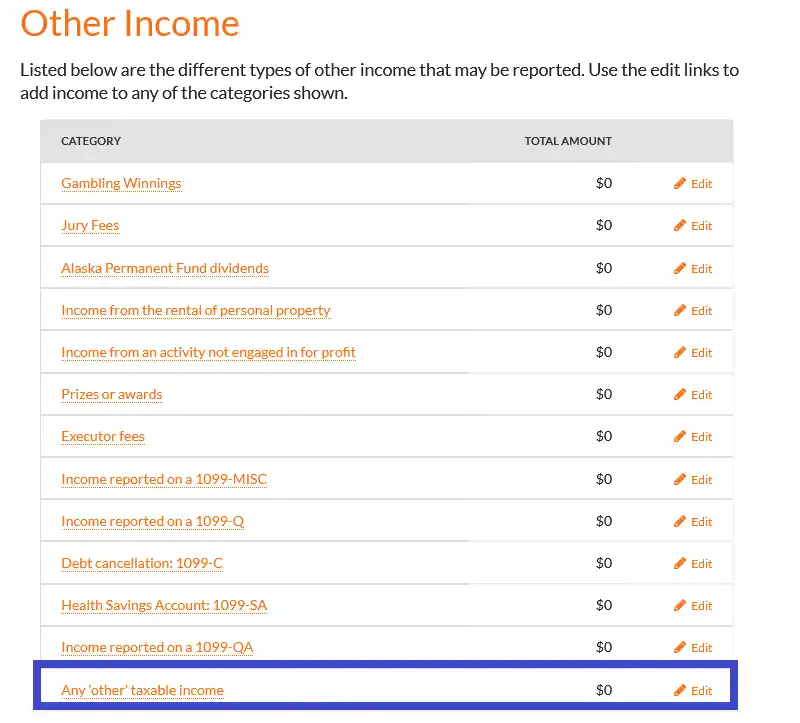

Select "Edit" next to "Any other taxable income".

On this page, you can add $1 of income with a description of “MISC”. You can then continue through to the end of the program to e-file your return.