How Do I Track My CT State Refund?

You can check the status of your Connecticut state tax refund by visiting myconneCT

Scroll down to Individuals and click “Where’s my Refund?”.

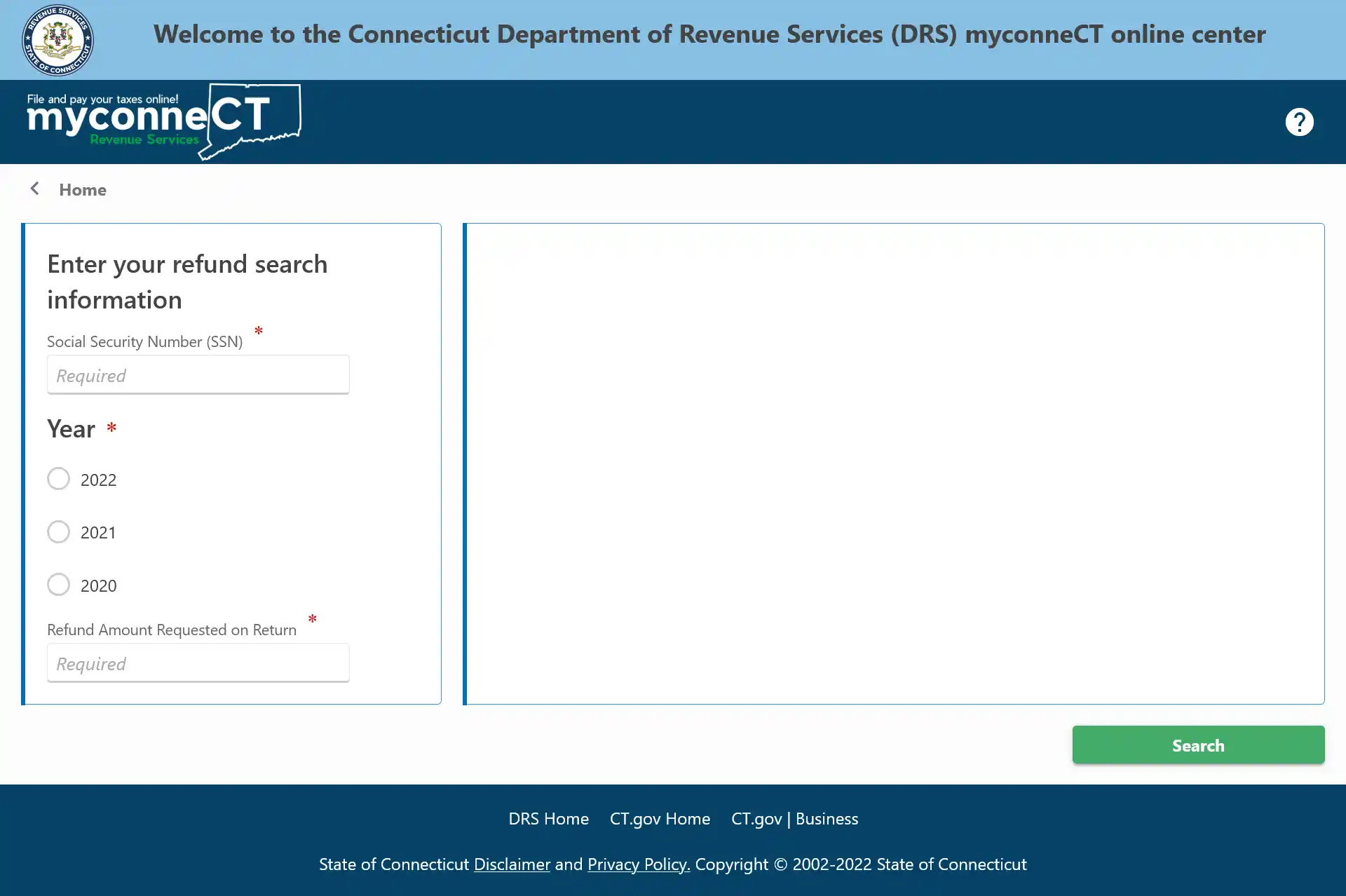

On this page you will need to enter:

- Your Social Security Number (SSN)

- The tax year

- The refund amount requested on your return. Enter the whole dollar amount followed by the # sign.

Then click the “Search” button to check your refund status.

Refund FAQs:

How long does CT take to process refund?

It takes 10-12 weeks for paper returns to be processed. E-filed returns will be processed faster.

What if my refund was lost, stolen, or destroyed?

If your tax refund was lost, stolen, or destroyed, the Connecticut Department of Revenue Services recommends filling out Form CT-3911, Taxpayer Statement Regarding State of Connecticut Tax Refund Mail your completed form to the address listed below or fax it to 860-297-5703.

Mail to:

Department of Revenue Services

Revenue Accounting Unit

PO Box 5035

Hartford CT 06102-5035