What Is a 1099-R Used For?

Form 1099-R is used to report distributions from retirement accounts. You should receive a copy of the form if you received a distribution of $10 or more from:

- Profit-sharing or retirement plans

- Individual retirement arrangements (IRAs)

- Annuities

- Pensions

- Insurance contracts

- Survivor income benefit plans

- Permanent and total disability payments under life insurance contracts

- Charitable gift annuities

Additionally, Form 1099-R is used to report any benefits that were rolled over from one retirement account to another.

What is the difference between a 1099-R and a W-2?

The key difference is that form 1099-R reports distributions from your retirement accounts, whereas a W-2 shows the income you earned from your employer.

Do I have to report my 1099-R on my tax return?

Yes, you have to report your 1099-R on your taxes. However, not all distributions are taxable. For example, if you do a direct rollover from a 401k to an IRA it would likely not be subject to taxes.

How do I determine the taxable amount on a 1099-R?

Usually, the taxable amount is listed in Box 2a of your 1099-R. If it’s blank and Box 2b is checked off, the payer was unable to determine the taxable amount. So, it’s up to you to figure it out.

Who needs to file a 1099-R?

The entity that manages your retirement plan, IRA, or pension will fill out a 1099-R for distributions of $10 or more. You will then use your 1099-R to file your individual tax return and pay any applicable taxes.

Do I have to pay taxes on a 1099-R?

You may have to pay taxes on the 1099-R depending on the type of distribution you received.

-

Early distributions – Most distributions you receive before age 59 ½ are considered early distributions. They are taxable and come with an additional 10% tax unless you qualify for an exception. Some exceptions to the early withdrawal penalty are:

- Death

- Total and permanent disability

- Emergency personal expenses

- IRS levy

- Unreimbursed medical expenses exceeding 7.5% of AGI

- Loans – Any money you borrow from your 401k is tax-exempt unless you default on the loan or leave your job. In that case, your distribution is deemed taxable income. You may also pay an early withdrawal penalty.

- Pension and annuity payments – If you didn’t make any after-tax contributions to your pension or annuity, your payments are fully taxable. However, if after-tax contributions were made, your distributions are only partially taxable.

- Rollovers – Direct rollovers from your old retirement plan to a new qualified plan are generally not taxed, unless you roll it into a Roth IRA.

Where do I enter form 1099-R?

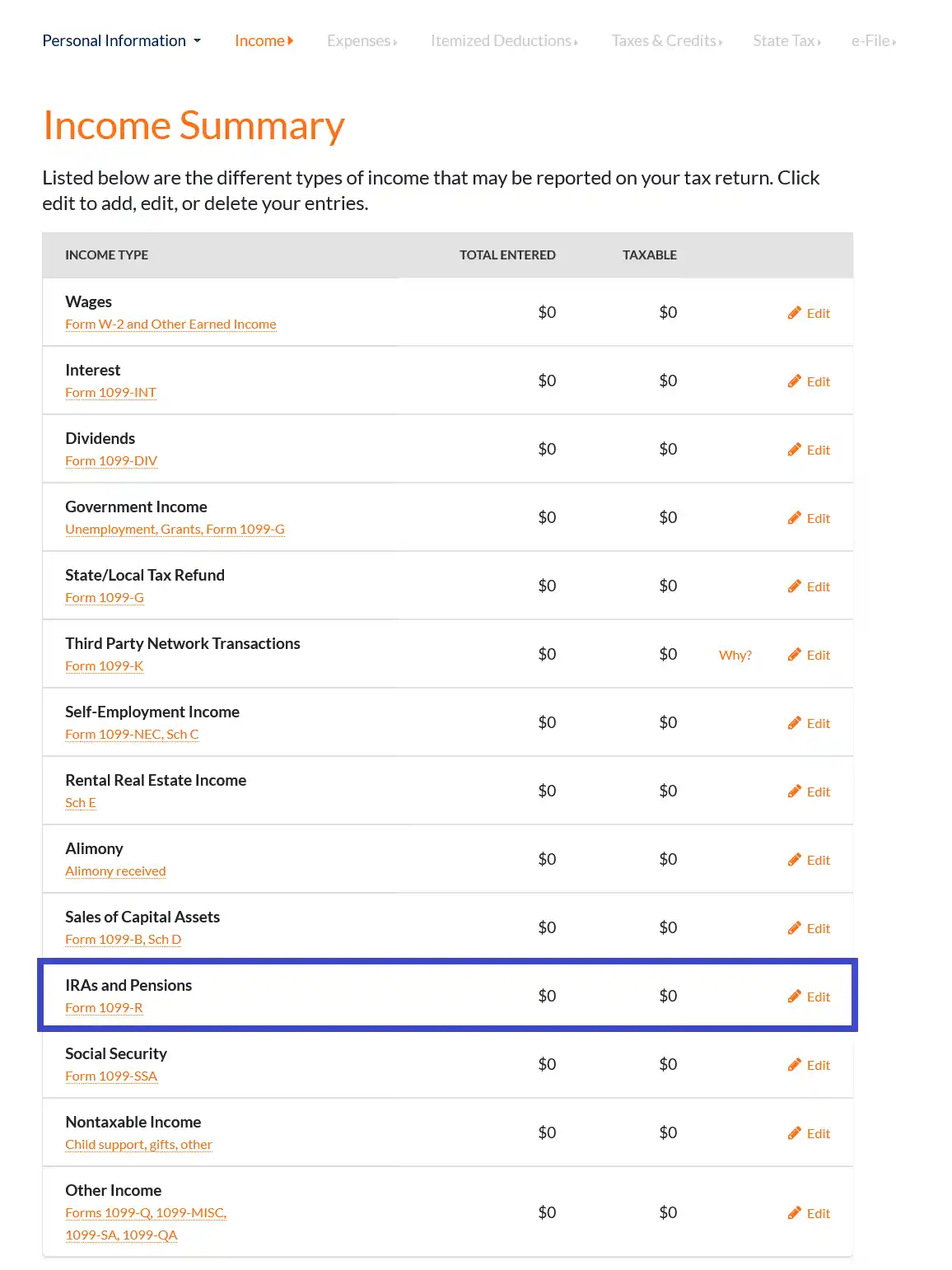

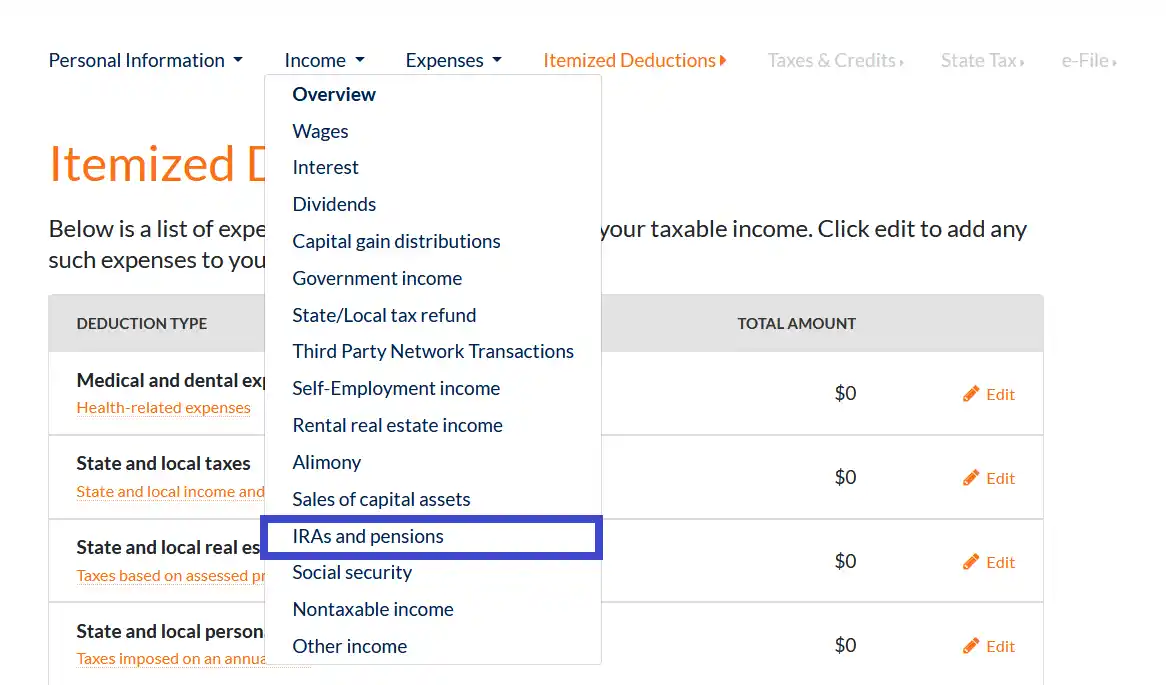

When you use ezTaxReturn.com, 1099-R forms are entered in the "IRAs and Pensions" section of the "Income" section of the program.

If you have already passed this section of the program, you can click the "Income" link on the navigation bar towards the top of the page and select "IRAs and Pensions" from the drop-down menu.

If you are on the "Income Summary" screen, click on the "edit" link on the "IRA's and Pensions" line to add, edit, or delete a 1099-R entry.