How Do I Track My Massachusetts State Refund?

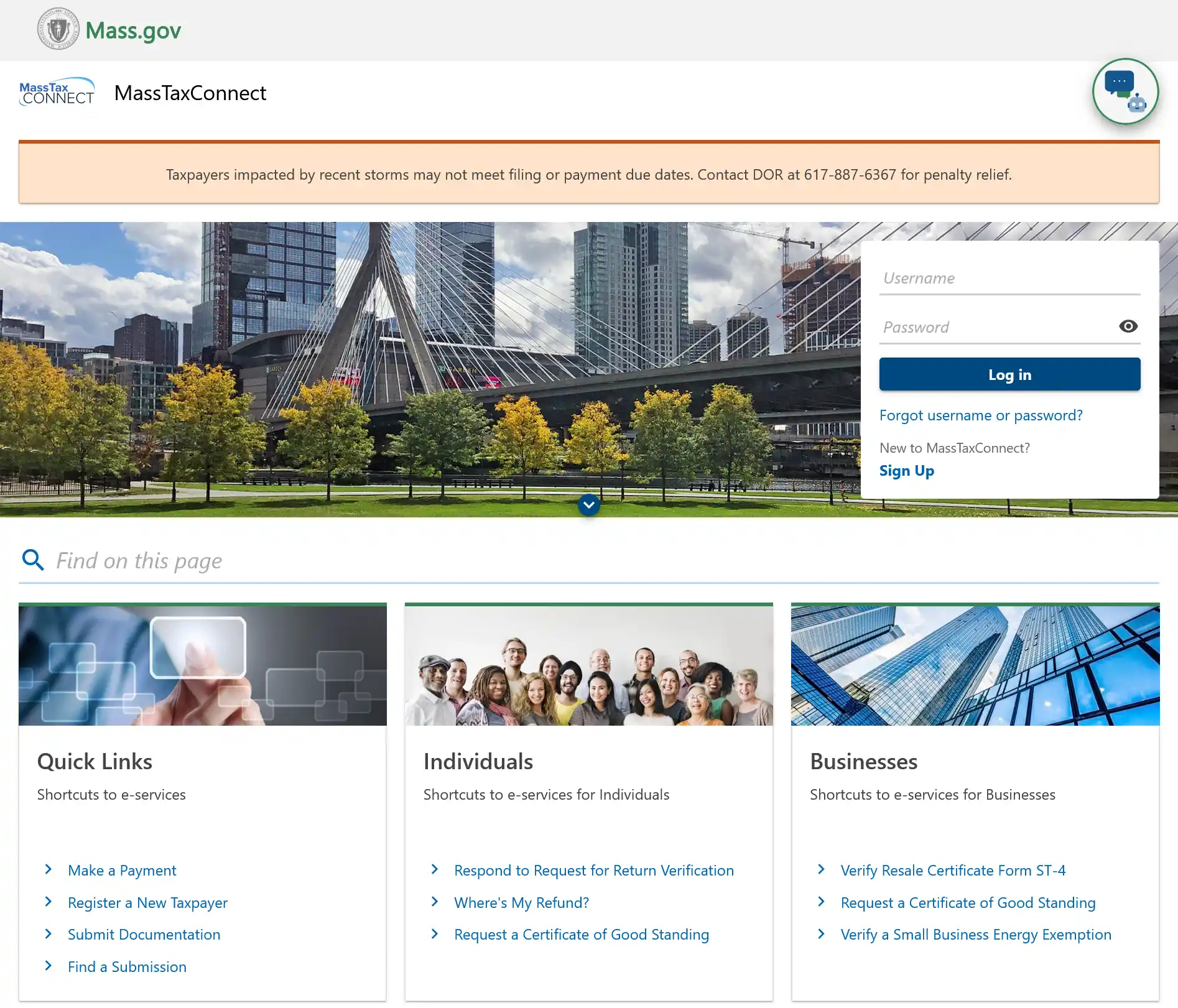

You can check the status of your Massachusetts tax refund by visiting MassTaxConnect at https://mtc.dor.state.ma.us/mtc/_/

Scroll down to “Individuals”, then click on “Where’s My Refund?”.

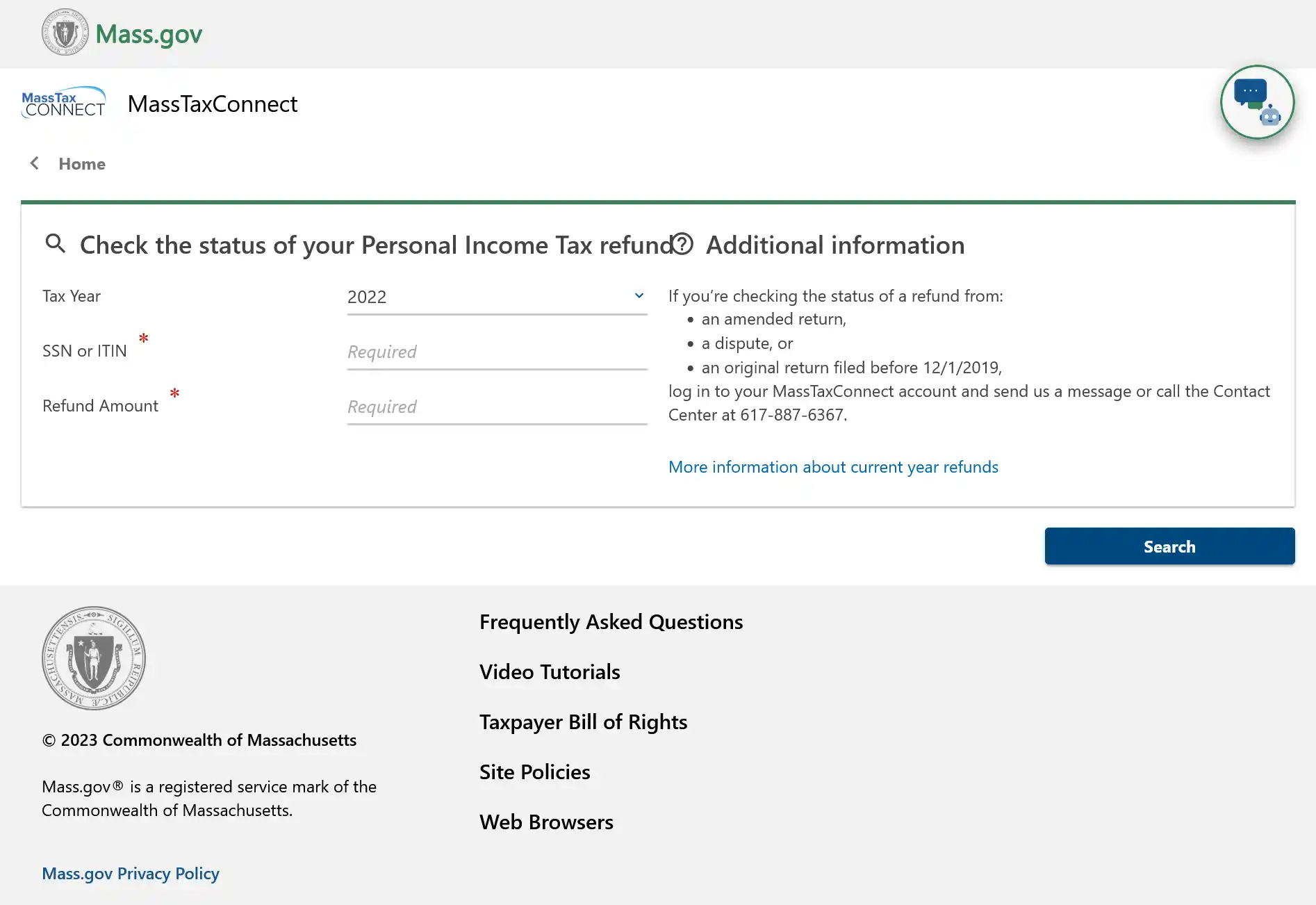

On this page, you will need to provide:

- Your SSN or ITIN;

- The tax year of your return; and

- Your refund amount.

Then click the “Search” button for your refund status.

Please Note: To check the status of a refund from an amended return, a dispute, or a tax return filed before 12/1/2019, you’ll need log in to your MassTaxConnect account and send a message through the portal. You can also call the Contact Center at 617-887-6367.

For more information, go to: https://www.mass.gov/how-to/check-the-status-of-your-ma-income-tax-refund.

Refund FAQs:

How long does it take to process a Massachusetts state tax refund?

| E-filed Returns | Paper Returns |

|---|---|

|

|

Why haven't I received my Massachusetts tax refund?

Your Massachusetts tax refund may be delayed if you:

- Accidently entered incorrect Social Security number.

- Mistyped or mismatched routing and/or account numbers.

- Your return was missing information.

- Amended your return.

- Filed too early.

- The Department of Revenue needs you to verify or provide more information.

- Your refund was intercepted to pay a past due tax bill or child support.

How do I contact the Massachusetts Tax Department?

You can call them at (617) 887-6367 or (800) 392-6089 (toll-free in Massachusetts). The Contact Center hours are 9 a.m. – 4 p.m., Monday through Friday.