How Do I Check on My Georgia State Tax Refund?

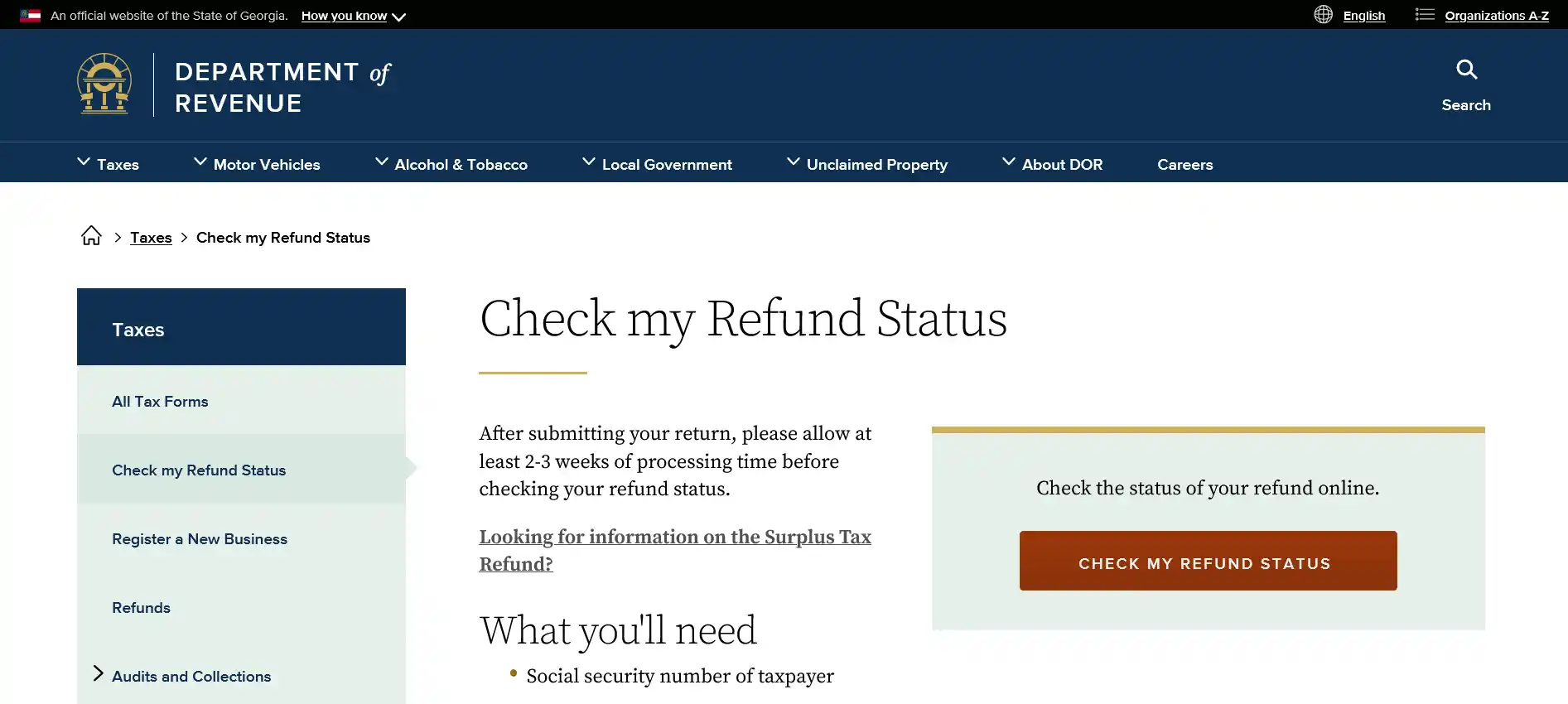

You can check the status of your Georgia tax refund online by visiting https://dor.georgia.gov/taxes/check-my-refund-status

Click the “CHECK MY REFUND STATUS” button.

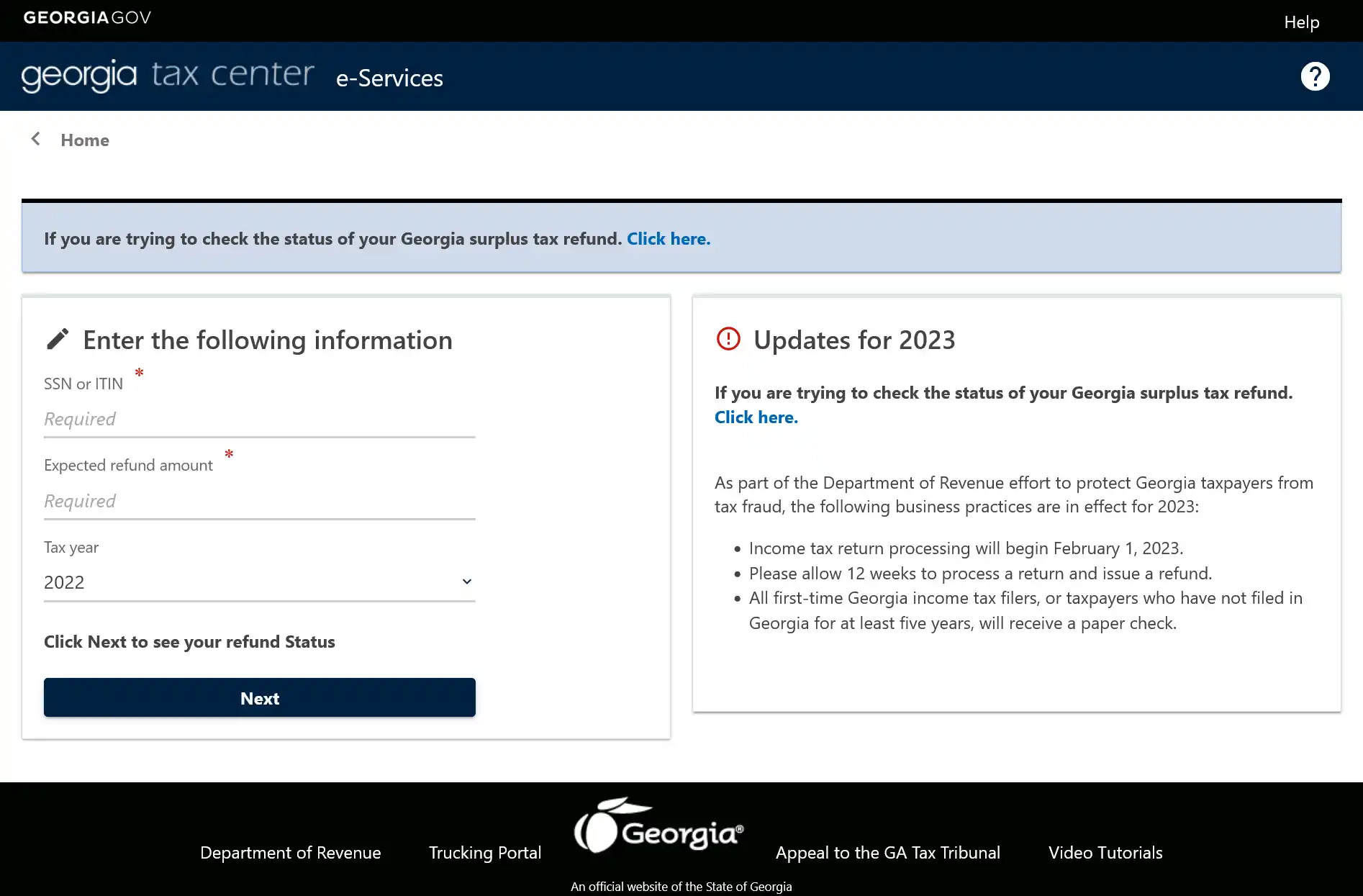

On this page, you will need to provide:

- Your SSN or ITIN;

- Your expected refund amount; and

- The tax year of your filed return.

Then, click “Next” to see your refund status.

Note: If you are first-time Georgia filer or have not filed Georgia taxes in at least five years, you will receive a paper check.

Refund FAQs:

When can I expect my GA state tax refund?

Most refunds are issued within 3 weeks, however, it may take as long as 12 weeks from the date of receipt by GADOR to process a return and issue a refund.

Why is my Georgia state refund taking so long?

Returns that contain errors or are incomplete take longer to process. Your refund may also be delayed if additional verification is required. For example, if you switched bank accounts or changed addresses in the past year. The DOR takes extra precautions to combat identity theft.

Can I check my refund status over the phone?

Yes, you can check your refund status using Georgia’s automated phone line by calling 877-423-6711.

How do I find what my Georgia state refund was from previous years?

You can find information about your previous refund by using the Georgia Tax Center (GTC) Learn how to sign up for online access.