Form 5498: IRA Contribution Information

Form 5498 reports the contributions you made to an individual retirement arrangement (IRA). This includes Roth and traditional IRAs, Simplified Employee Pension (SEP), Savings Incentive Match Plan for Employees (SIMPLE), and deemed IRAs.

What’s on form 5498?

On the left side of form 5498 you’ll see the Trustee’s name, address, and Taxpayer Identification Number (TIN). Followed by your name, address, and TIN. Here’s some other information you will find:

- Box 1 shows your IRA contributions.

- Box 2 shows your rollover contributions.

- Box 3 of form 5498 shows your Roth IRA conversion amount.

- Box 7 Is the type of IRA (Traditional, SEP, SIMPLE, or Roth) to which contributions were made.

- Box 8 is the amount you contributed to a Simplified Employee Pension (SEP).

- Box 9 is the amount you contributed to a Savings Incentive Match Plan for Employees (SIMPLE IRA)

- Box 10 shows your Roth IRA contributions.

When will I receive form 5498?

Your IRA trustee or issuer must file Form 5498 by May 31st. It is sent later in the year because you have until the tax filing deadline to make IRA contributions.

Do I need to report form 5498 on my tax return?

Form 5498 is only for your records, but you should compare it to the contributions claimed on your tax return to make sure the numbers match. If it does not, you may need to amend your tax return.

How do I report IRA contributions on my tax return?

IRA contributions can be entered in the "Expenses" section of the ezTaxReturn program under "IRA Contributions”.

If you have not yet reached the "Expenses" section of the program, simply continue until you reach "IRA Contributions."

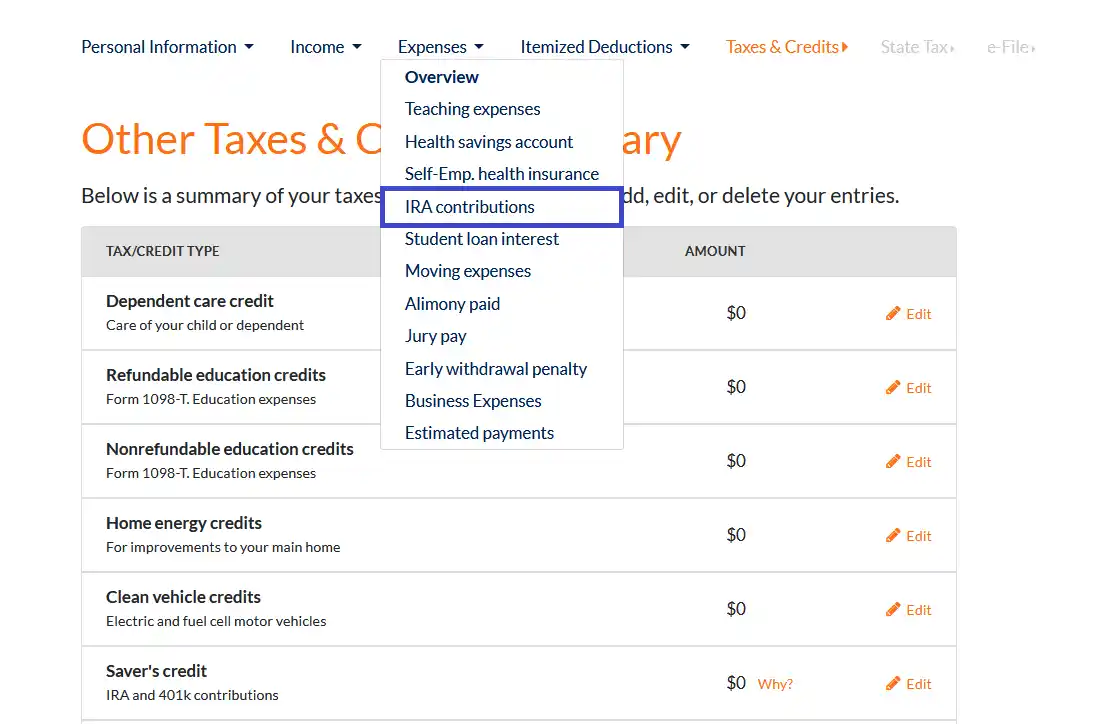

If you have already passed this section of the program, you can click the "Expenses" link on the navigation bar towards the top of the page and select "IRA Contributions" from the drop-down menu.

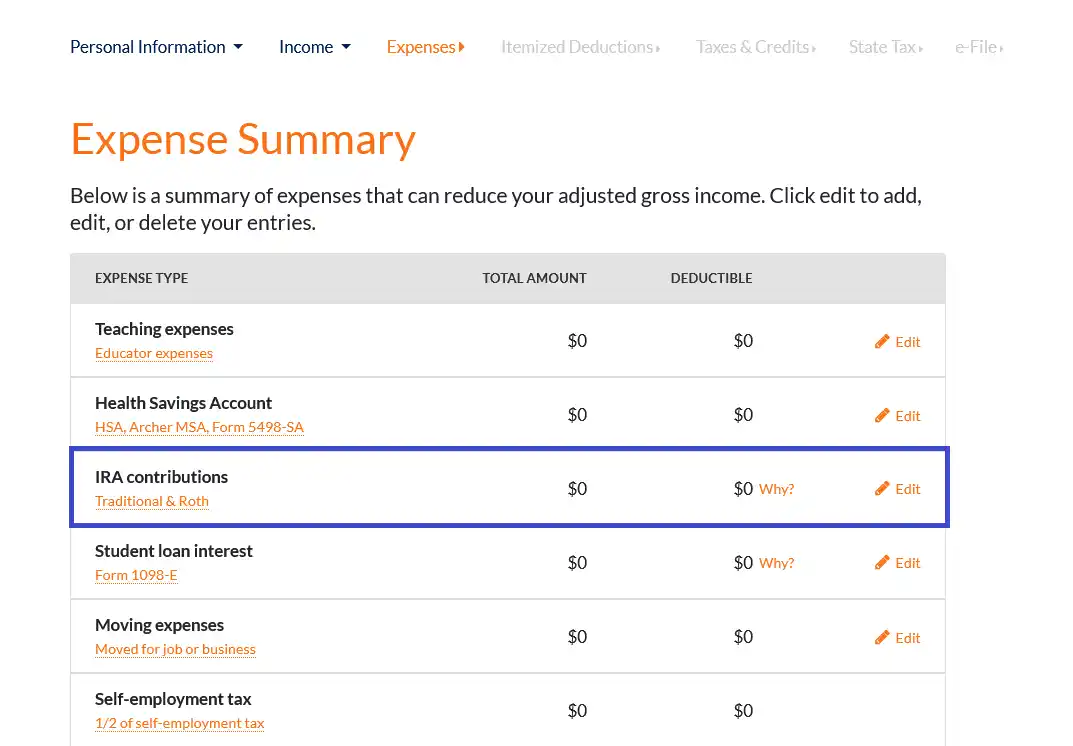

If you are on the "Expense Summary" screen, click on the "Edit" link on the "IRA Contributions" line to add, edit, or delete an IRA Contribution entry.

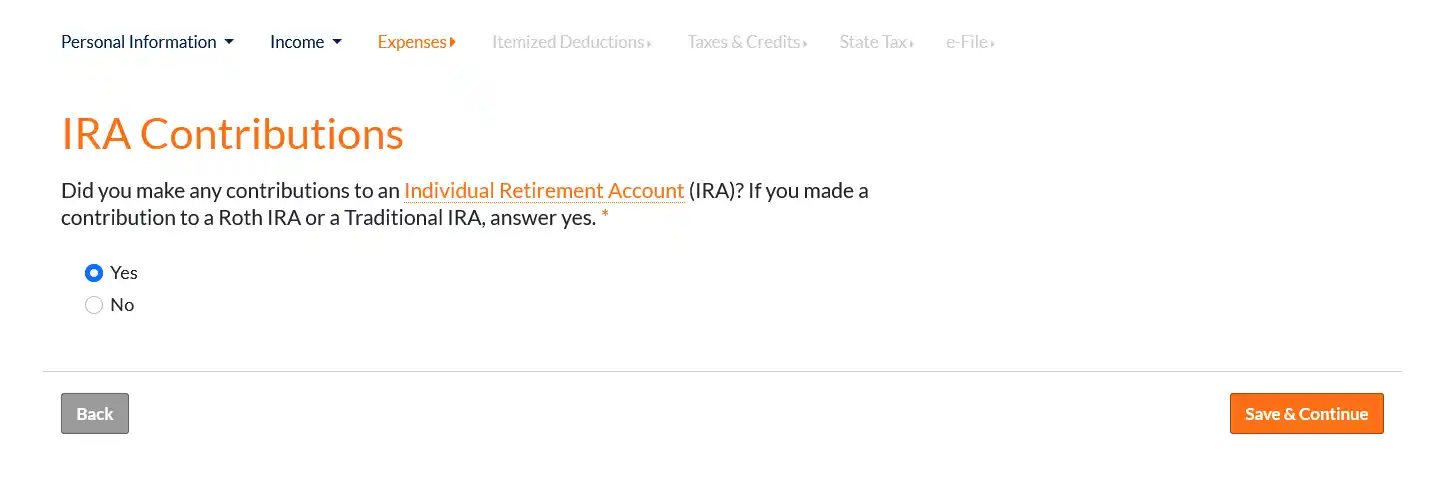

This will take you through the necessary questions and screens to enter information regarding your Traditional or Roth IRA contributions.

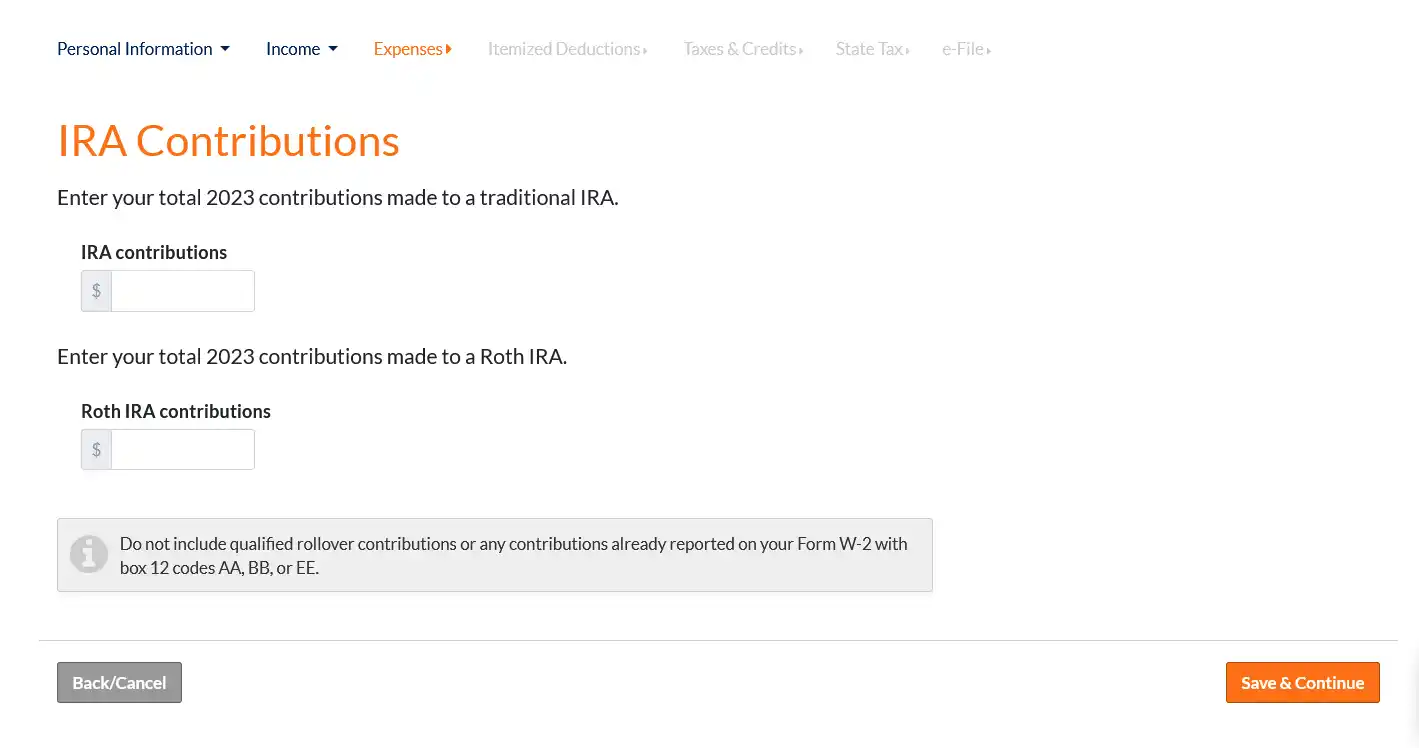

If you made contributions to a traditional IRA in 2024, you may be able to deduct up to $7,000 of those contributions ($8,000 if you are 50 or older) from your taxable income.

Make sure to enter any contributions you made to a Roth IRA as well. While you may not be able to deduct your contributions, your contributions may qualify you for the Retirement Savings Credit.

What is the difference between a 5498 and a 1099-R?

The difference is that form 1099-R reports distributions of $10 or more than were taken from your retirement accounts. Meanwhile, form 5498 reports IRA contributions, rollovers, and the Fair Market Value (FMV) of your account. It also provides details about your Required Minimum Distributions (RMDs).