Have you paid for the use of our DIY tax filing software? If yes, please WAIT! It’s not the finish line. You are almost there, but you still have to e-file your return!

Many people make the mistake of quitting the program too early. Once they submit a payment and can access their return, they log out.

Even after you have paid, please know that you must still continue to the very end of the program until you reach the “Final Step!” page!

You will know you are done once the “Continue” button changes to the “e-file My Return” button and you click it!

Ready to complete the final step?

Please sign back in now to finish e-filing. IT ONLY TAKES A FEW MINUTES!

How to finish your online return?

1. If you have already completed your taxes with ezTaxReturn, please sign into your account to access your “myAccount” page.

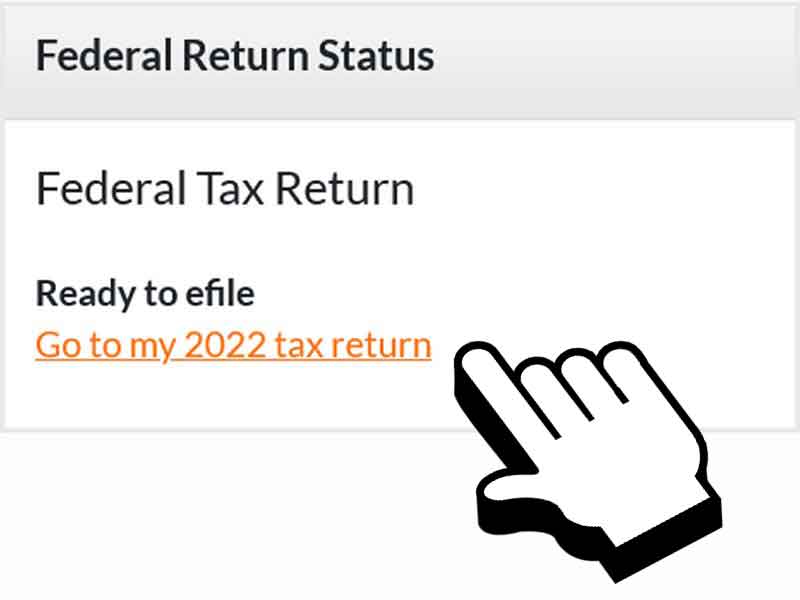

2. In the “Federal Tax Return” section, you will see “Ready to efile”. Right underneath it you will also see “Go to my 2022 tax return”. Please click on that link.

3. As you make your way to the end of the program, you will be asked to enter a License or State-Issued ID. The IRS requests this information to help combat fraud.

4. Before being able to click the “e-file My Return” button, the program should also ask you to pass a quick “I am not a Robot” reCAPTCHA Test.

5. When you click the “e-file My Return” button on the “Final Step!” page, your federal return will be e-filed. You will be able to see the real-time status of your return on your MyAccount page.

Please note that most people receive IRS acknowledgement within 24 hours, so expect an email confirmation.

Happy e-filing!