There’s a lot of bad information floating around the internet. For instance, the idea that you can see the Great Wall of China from space or that we only use 10 percent of our brains. Believing everything you read not only makes you look foolish, it can lead to costly mistakes. The good news is we know taxes and we’re willing to share our knowledge with you. Keep reading to find out the truth behind the most popular tax myths.

Filing taxes is voluntary

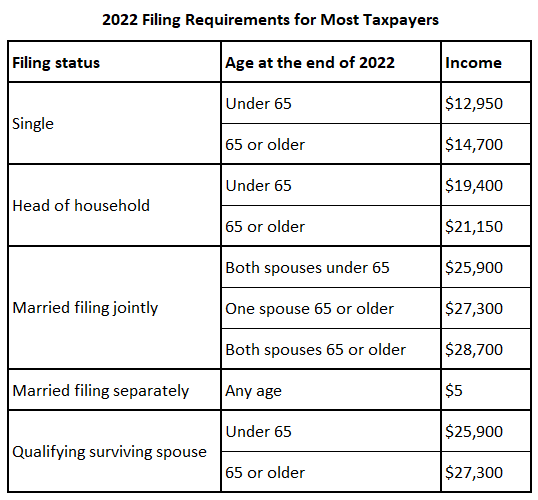

Getting married is optional. Going to college is optional. Filing your taxes? Not so much. The IRS requires you to file a tax return if your income exceeds a certain threshold based on your age and filing status. See the chart below.

Even if you are exempt from filing, it is still a good idea to do it anyway. You will get a refund of any federal income tax withheld and you may qualify for tax breaks which can increase your refund even further. ezTaxReturn.com is the fastest and easiest way to do your taxes. File now to avoid the last-minute hassle.

Students don’t have to file taxes

The IRS doesn’t care that you’re a student. They have a one-track mind and for them it is all about the money. Single dependents under the age of 65 and not blind must file a tax return if they earned more than $12,950 or have over $1,150 in unearned income such as interest, dividends or capital gains. First time filing as a college student? Here’s what you need to make tax time easier.

- Your social security number or taxpayer ID number

- You bank account and routing numbers to receive your refund via direct deposit

- Form W-2, Wage and Tax Statement

- Form 1098-T, Tuition Statement

- Form 1098-E, Student Loan Interest Statement

- Records of any scholarships and grants you received

Be sure to check out the “4 Biggest Tax Breaks for Education“, so you know what’s available.

Married couples must file a joint return

Contrary to popular belief, you don’t have to file a joint tax return with your spouse if you don’t want to. Filing separately disqualifies you from claiming certain tax breaks but in some cases it’s still a smart move. For example, if your spouse owes back taxes, child support or student loans and you want to protect your refund. It’s also a good idea to file separately if you simply don’t trust your partner. When you file jointly, both parties are responsible for the return’s accuracy. So, if your partner decides to omit or overstate information, both of you are on the hook.

Filing an extension gives you more time to pay

This is actually one of the costliest tax filing mistakes you can make. Requesting an extension only gives you more time to do your taxes, not to pay them. If you owe the IRS and don’t pay by Tax Day, you’ll begin accumulating penalties and interest. The penalty for filing late is 5 percent of your unpaid taxes. Meanwhile, the late payment penalty starts at 0.5 percent of the unpaid tax. Both penalties can climb up to a maximum of 25 percent.

Social Security isn’t taxable

Usually you don’t have to pay taxes on your Social Security benefits if it’s your only source of income. You only have to worry when additional income is involved. As a single filer, you will pay taxes on up to 50 percent of your benefits if your combined income is between $25,000 and $34,000. That number jumps to 85 percent if it’s more than $34,000. Married couples filing a joint return pay taxes on 50 percent of their benefits when their combined income is between $32,000 and $44,000. Once you exceed $44,000, up to 85 percent of your benefits may be taxable.

You don’t have to file if you’re unemployed

We hate to break the bad news, but unemployment compensation is considered taxable income. At the end of the year, you’ll receive a form 1099-G showing the amount you were paid and report it on your tax return. If you chose not to have taxes withheld from your pay, there is a good chance you will owe the IRS when you file.

You must hire a CPA to prepare your tax return

Many people fear doing their taxes themselves because they think they’ll get it wrong and land in hot water with the IRS. But the reality is if you have a basic tax situation such as a W-2 and no dependents, you’re totally capable of preparing your own tax return. Save time and money by doing your taxes with ezTaxReturn.com. We guide you step-by-step and take care of all the hard stuff. File in 30 minutes or less and pay $0 for a simple return.

The IRS has been calling you

Despite what your caller ID says it probably isn’t the IRS on the phone. Savvy criminals have been impersonating IRS employees to scam taxpayers out of their hard-earned cash. Usually, they will tell you that you owe money for a fraudulent bill and demand immediate payment via prepaid debit card, gift card or wire transfer. The crooks really want you to take the bait, so they will threaten to have a warrant issued for your arrest or your license revoked if you don’t comply. This is not how the real IRS does business. If the IRS needs to get in touch with you, the first thing they will do is send a letter through the U.S. mail. Leaving pre-recorded, urgent or threatening messages is not their style.