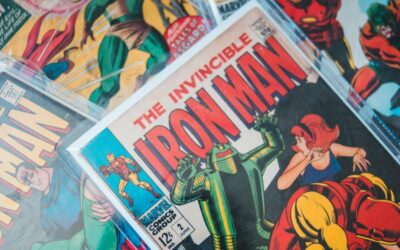

Who Is the Richest Superhero?

Ever wondered who is the richest superhero? While we’re all familiar with capes, powers, and epic battles, some superheroes are also rolling in money—more than most of us can even dream of! Whether it’s from genius-level intellect, massive inheritances, or tech empires, these heroes...

Does Your Teen Need to File Taxes for Their Part-time Job?

The information in this article is up to date for tax year 2024 (returns filed in 2025). Taxes are usually associated with adulthood, but if you’re a teen with a job or other streams of income, you may be required to file your own taxes. (Sorry to break it to you). But don’t let...

9 Ways to Pay Off Your Mortgage Early and Save Big on Interest

Although most fixed-rate mortgages are for 30 years, it doesn’t have to take that long to pay it off. There are several strategies you can use to speed up the process, reduce the amount you pay in interest, and own your home sooner. However, it’s important to consider the...

9 Ways to Simplify Your Financial Life

Managing your finances can feel overwhelming, especially when you're trying to juggle multiple goals at once. It's easy to get caught up in strict budgets or ambitious plans that end up leaving you stressed out and unsure where to start. The key to simplifying your financial life is...

Married Filing Separately: Is It Right for You?

Considering the married filing separately tax status? This option lets each spouse file their own tax return. It’s not as common as filing jointly, but it can be advantageous under certain conditions. In this article, we’ll explore exactly what married filing separately means, when...

Is Auto Registration Tax Deductible? Find Out Here!

The information in this article is up to date for tax year 2024 (returns filed in 2025). Are auto registration fees tax deductible? The short answer is: sometimes. Only the portion of your registration fee that is based on the value of your vehicle can usually be deducted on your...

What is the Standard Deduction?

The information in this article is up to date for tax year 2024 (returns filed in 2025). Wondering what is the standard deduction and how it impacts your taxes? You’re not alone! If you’ve ever filed your taxes or looked into the process, you’ve probably heard the term before, but...

Lucky Day at the Casino? 7 Tips to Report Your Gambling Winnings

The information in this article is up to date for tax year 2024 (returns filed in 2025). From the racetrack to the slot machines, legalized gambling has surged across the U.S., with states embracing the potential tax revenue. This growing trend means that more people are gambling,...