Are you trying to improve your credit score? Well, you’re not alone. According to a NerdWallet survey, 4 out 5 Americans are currently working on their credit. Good credit can help you qualify for lower interest rates, higher credit limits, and other perks. Even if you aren’t planning to apply for a loan soon, many life decisions revolve around your credit. It can affect your ability to rent an apartment, land your dream job, or can cause you to pay higher insurance premiums. While there are no shortcuts for building a higher credit score, there are steps you can take to raise your credit score as quickly as possible.

How are credit scores calculated?

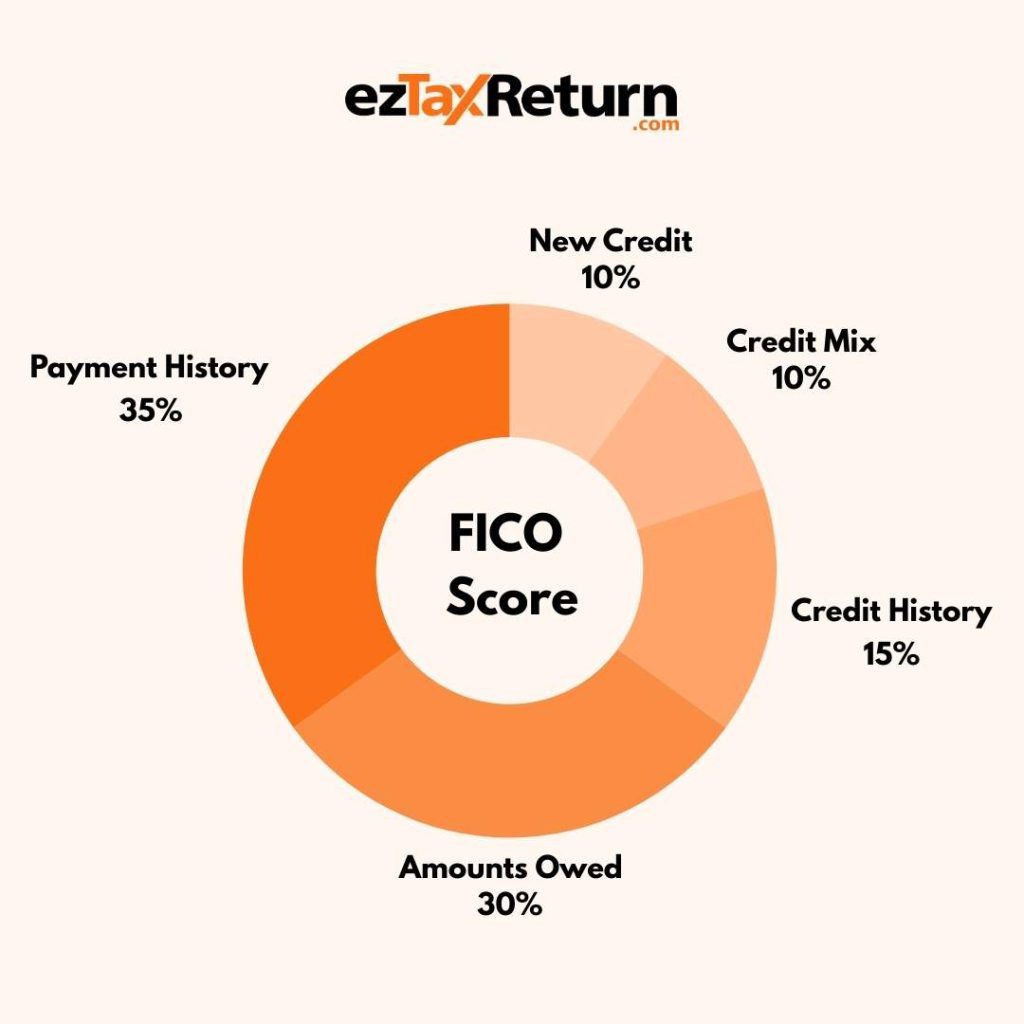

Most lenders use FICO scores to make their lending decisions. FICO scores are calculated based on five different categories: payment history (35%), amounts owed (30%), length of credit history (15%), new credit (10%) and credit mix (10%).

What is a good credit score?

FICO scores can range anywhere from 300-850, but a good FICO score is classified as 670 to 739. Ideally, you want to get your credit score even higher if you can. The closer your credit score is to the 850 mark, the lower your interest rates will be and the more money you will save over the course of your loan. The credit score ranges are:

- 800 to 850: Exceptional credit

- 740 to 799: Very good credit

- 670 to 739: Good credit

- 580 to 669: Fair credit

- 300 to 579: Poor credit

How to improve your credit score fast

1. Check your credit report

The first step to improving your credit score is knowing where you currently stand. Request a free copy of your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion) and review it for any errors or inaccuracies. Common errors people find on their credit reports are:

- Wrong name, phone number or address

- Accounts belonging to someone with a similar name as yours

- Fraudulent accounts due to identity theft

- “Closed” accounts listed as “open”

- Accounts incorrectly reported as late or delinquent

- The same loan listed more than once

- Accounts with an incorrect balance or credit limit

If you need to correct errors on your credit report, you will need to file a dispute with the credit bureau and the business that reported the inaccurate information.

2. Pay down debt

One of the most effective ways to boost your credit score is to reduce your credit utilization ratio. Aim to keep your credit card balances below 30% of your available credit limit. That means if you have a $5,000 credit limit, keep your spending under $1,500. Paying off high-interest debt first can also help improve your credit score.

3. Make payments on time

Your payment history is a significant factor in determining your credit score. Set up automatic payments or reminders to ensure that you never miss a due date. Consistently making on-time payments will help improve your credit score over time.

4. Use credit responsibly

Avoid opening multiple new credit accounts at once, as this can lower your average account age and negatively impact your credit score. Instead, focus on using your existing credit responsibly by keeping balances low and paying on time.

5. Consider a secured credit card

If you have a limited credit history or poor credit, a secured credit card can help you build or improve your credit score. Secured cards require you to make a security deposit equal to your credit limit. You can use the card online or in-stores just like a traditional credit card. Every month your account activity will be reported to the credit bureaus. Make timely payments and gradually improve your credit score. The downside is that most secured credit cards tend to come with annual fees, high interest rates, and low credit limits.

6. Monitor your credit regularly

Keep a close eye on your credit score and credit report to track your progress and identify any issues that may arise. You can use free credit monitoring services to stay informed about changes to your credit profile. Most credit card issuers offer free credit scores if you’re a cardholder.

7. Diversify your credit mix

If you only have credit cards, consider diversifying your credit mix. Having a mixture of revolving (credit cards, lines of credit, HELOCs) and installment credit accounts (student loans, auto loans, mortgages) can help raise your credit score over time. It shows lenders that you know how to handle different kinds of debt.

By following these steps and being proactive about managing your credit, you can raise your credit score quickly and improve your overall financial health. Remember that improving your credit score takes time and patience, but the benefits of having a good credit score are well worth the effort.

Ready for your biggest refund?

The articles and content published on this blog are provided for informational purposes only. The information presented is not intended to be, and should not be taken as, legal, financial, or professional advice. Readers are advised to seek appropriate professional guidance and conduct their own due diligence before making any decisions based on the information provided.