It’s not too early to start thinking about your 2020 tax return. Learning the latest rules can help you strategize ways to reduce your tax bill and boost your refund. Here are some changes to expect when you file your taxes in 2021.

Increased standard deduction amounts

When you do your taxes next year you’ll have the option of 1) taking the standard deduction, which is a set dollar amount that reduces your taxable income, or 2) adding up your eligible expenses and itemizing instead. Most people claim the standard deduction because it’s easier. Next season, the standard deduction is getting a slight boost. So for tax year 2020, it’s $12,400 for single filers, $18,650 for head of household and $24,800 for married couples filing a joint return.

The EITC will be worth up to $6,660

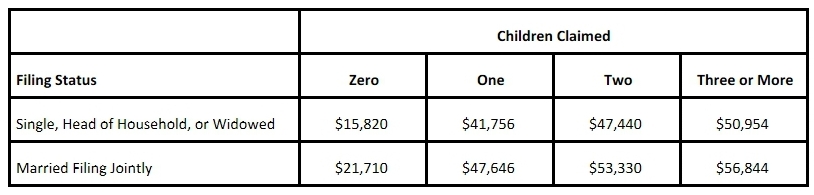

The maximum credit amount of the Earned Income Tax Credit is going up, too. Depending on your filing status and the number of children you have, you can receive up to $6,660. To qualify, your adjusted gross income cannot exceed the threshold. Here are the limits:

Additionally, your investment income must be less than $3,650 for the year.

How much is the credit worth? While anyone can qualify for the EITC, parents usually reap most of the benefits especially those with multiple kids. The maximum credit amounts for 2020 are:

- $538 with no qualifying children

- $3,584 with one qualifying child

- $5,920 with two qualifying children

- $6,660 with three or more qualifying children

One in five eligible taxpayers fail to take advantage of the EITC they’ve earned. Don’t let it be you. ezTaxReturn.com makes it fast and easy to claim the EITC and any other tax break you deserve.

No additional taxes for tapping your retirement account early

Normally, if you withdraw funds from your 401K or IRA before age 59 ½, you’ll need to pay regular taxes and a 10% penalty. However, the IRS has adjusted the rules so taxpayers affected by COVID-19 can withdraw up to $100,000 from their retirement plan. The coronavirus-related distributions will not be subject to the 10% early withdrawal penalty, but the distribution must be repaid within three years. You may qualify for relief if:

- You tested positive and were diagnosed with COVID-19

- Your spouse or dependent tested positive or was diagnosed with COVID-19

- You, your spouse, or another member of your household experienced financial hardship due to being quarantined, laid off, furloughed, having your hours cut, a job offer rescinded, or start date pushed back. You can also qualify if you were unable to work due to lack of childcare.

Higher contribution limits for retirement accounts

Employees who participate in a 401k, 403b and most 457 plans can stash a little more into their savings this year. The contribution limit has increased from $19,000 to $19,500 for 2020. Those aged 50 or older can also make catch-up contributions up to $6,500.

No RMD (Required Minimum Distribution) necessary for 2020

Usually you must start taking required minimum distributions (RMD) from a traditional IRA, 401k or 403b plan once you turn age 70 ½. Under the CARES Act, you can skip the RMD for 2020.

There’s a new $300 charitable contribution deduction

In prior years, you needed to itemize to deduct charitable contributions on your return. Thanks to the CARES Act there’s a new above the line deduction you can take. The new law allows non-itemizers to deduct $300 for charitable contributions. So, hold on to your receipts if you made a cash donation to a qualified organization this year.

You can claim missing stimulus money on your 2020 return

Earlier this year the IRS issued millions of stimulus payments. If your adjusted gross income was $75,000 or less, you received a full payment of $1,200. Plus, $500 for each dependent aged 16 or younger listed on your tax return. Since the payment was based on your 2018 or 2019 tax return, if you recently experienced a life change such as having a baby, you probably didn’t receive the payment you deserve. The good news is you’ll be able to claim the additional funds when you file your tax return. The fastest and easiest way to do your taxes is with ezTaxReturn.com. Pre-register now and receive an automatic discount when you file with us next year.