Want to save more money this year? We hope the answer is yes because we have some money saving challenges that can boost your bank account. Money saving challenges are popular because they give you a goal and a plan for success. All you have to do is follow through. So, put on your game face and let’s get down to business.

Save 10% of your income per month

Sixty-nine percent of Americans have less than $1,000 to their name. Let’s strive to change that. From this day forward, aim to save 10% of your salary every month. Do the math to see how much you’d need to set aside each paycheck then set up automatic transfers with your bank. Every so often, you can increase the percentage so your savings grow faster.

$5 bill challenge

For people who still rely on cash for everyday purchases, the $5 challenge is right up your alley. Basically, all you do is save every five-dollar bill you come across. You’ll be amazed by how quickly the bills add up. If you’re working with a very tight budget, you can modify the challenge by aiming to save your singles instead. The important thing is to save every bill.

Set aside $50 per week

Commit to saving $50 per week for the entire year. By the end of 2020, you’ll have $2,600 in your bank account. Easy ways to reach your goal include eating out less, using coupons/promo codes and cutting out services you no longer use.

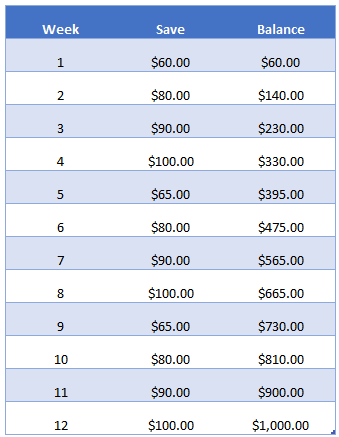

Save $1,000 in 3 months

Want to save $1,000 quickly? Try this 3-month saving challenge. Each week you’ll set aside between $60 to $100. You can hit your weekly goals by cutting back your expenses, selling things you don’t need or working a side gig. If you stick to the plan, you’ll have $1,000 by the end of the challenge.

No spend challenge

Reports show that Americans spend $1,497 per month on nonessential items. That’s almost $18,000 a year being thrown down the drain. If your budget is out of control, a no spend challenge is a great way to get back on track. How it works is you’re not allowed to spend any money on wants, only needs. This includes your rent/mortgage, utilities, insurance, phone, gas and groceries. Everything else gets the ax. Typically, the challenge lasts anywhere from a month to a full year, the time frame is up to you. Here are some tips for success.

- Plan all your meals. Try to use up all the food stored in your freezer and pantry.

- Look for free activities.

- Make sure your family and friends are aware of your plans.

- Stock up on staple items before you start the challenge.

- Unsubscribe from store emails.

- Leave your cash and credit cards at home.

- Use up any gift cards you have.

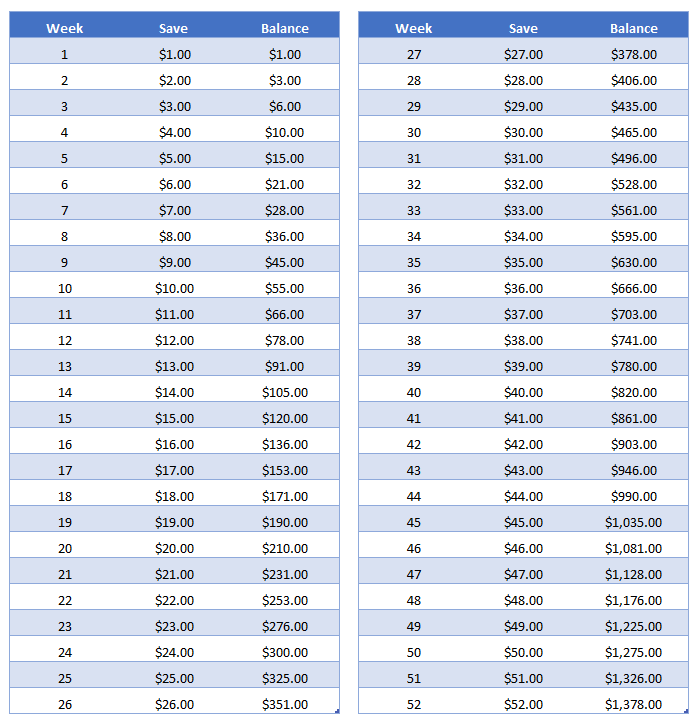

The 52-week money saving challenge

You can’t have a money saving challenge article without mentioning the most famous one. The 52-week challenge starts with one dollar and by the end you’ll have $1,378 in the bank. There are numerous ways to complete the challenge. You can follow it as is or work in reverse. Some people prefer working backwards because Christmas makes it too hard to save large amounts at the end of the year. Another option is to jump around. Set aside any amount on the chart and cross it off the list. You’ll do this until you’ve covered every amount.

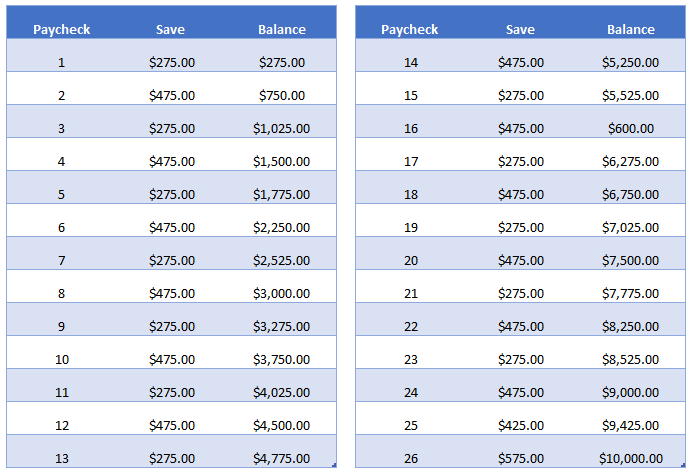

The $10,000 money saving challenge

There are a lot of smart things you can do with $10,000. You can buy a used car, put a down payment on a house or even start a business. Saving that kind of cash may seem far-fetched, but you’ll see that it really is possible once you break down the numbers. The chart below is based on a bi-weekly paycheck.

If you prefer to save a set amount, setup weekly automatic transfers for $193. This will give you $10,036 by the end of the year. You can also put any windfalls you receive throughout the year towards your goal. In 2019, over 111 million people received a tax refund with the average amount being $2,860. When you do your taxes with ezTaxReturn.com, you’ll receive the biggest possible refund, guaranteed.