What Is the Difference Between Gross Income and Net?

The information in this article is up to date for tax year 2025 (returns filed in 2026). Gross income is your total earnings before any deductions, while net income refers to what you take home after taxes and other deductions. In this article, we’ll explain the differences between...

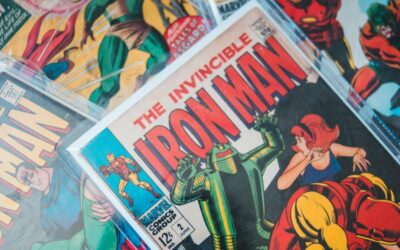

Who Is the Richest Superhero?

Ever wondered who is the richest superhero? While we’re all familiar with capes, powers, and epic battles, some superheroes are also rolling in money—more than most of us can even dream of! Whether it’s from genius-level intellect, massive inheritances, or tech empires, these heroes...

6 Reasons You May End Up Owing Taxes in April

The information in this article is up to date for tax year 2025 (returns filed in 2026). Betting on a tax refund this year? Although many filers get a refund, it’s not guaranteed. Even if you had taxes withheld from your paycheck all year, there’s still a possibility that you...

7 Money-Saving Tips for a Cheap Road Trip

There are many ways to travel the world but nothing beats a good old fashioned road trip. You can move at your own pace, discover new sights and create some unforgettable memories. Depending on the destination, it can also be a lot cheaper than flying. Here’s how...

5 Tips to Help You Save Your First $1,000

We’d all love to have a nice cushion in the bank. It doesn’t have to be six figures but enough to cover an emergency without panicking. Unfortunately, that isn’t the case for most Americans. More than half of them have less than $1,000 saved. The most common issues holding them back...

Income Tax Withholding and Estimated Tax Payments

The information in this article is up to date for tax year 2025 (returns filed in 2026). Didn’t ask your employer to withhold enough taxes? You may have a tax liability on your hands due to insufficient federal tax withholding. A tax filer can end up paying more than what’s withheld...

Tax Tips for Content Creators

The information in this article is up to date for tax year 2025 (returns filed in 2026). Today, content is everywhere. And behind every piece of content is a creator. Sometimes this is a corporate brand, but increasingly digital content is produced and distributed by individual...

How to Save Money on Streaming Services

Streaming services have revolutionized how we consume entertainment, offering endless content at the click of a button. However, as the number of platforms grows, so do the subscription fees. If you’re a fan of streaming but don’t want to break the bank, there are plenty of ways to...